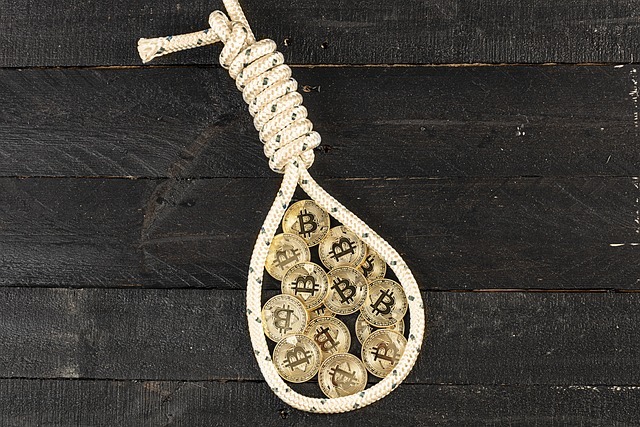

- Bitcoin recently dropped 18% from its December 2024 high of $106,000, driven by institutional sell-offs, record liquidations, and profit-taking after Donald Trump’s election.

- While some fear a prolonged downturn, experts believe the market’s maturity, regulatory support, and past resilience suggest this is just a temporary correction.

The cryptocurrency market has once again proven its volatility as Bitcoin, after reaching a record-breaking high of $106,000 in December 2024, has experienced a sharp 18% decline. While some investors panic, seasoned traders see this as just another phase in Bitcoin’s long and turbulent history. So, what’s really behind this drop, and what does it mean for the future of the market?

A Sudden Reversal After a Historic High

Bitcoin’s surge to $106,000 was fueled by optimism surrounding Donald Trump’s election victory. However, following his inauguration in January 2025, the market sentiment shifted dramatically. The sharp downturn saw Bitcoin shedding a significant chunk of its gains, dragging the total cryptocurrency market capitalization down by 25%.

Several key factors contributed to this sudden drop:

- Massive Institutional Sell-offs: Crypto investment funds saw a staggering $4.6 billion in outflows, signaling reduced confidence from institutional players.

- Record Liquidations: March 3 witnessed over $1 billion in liquidated positions, further exacerbating the selling pressure.

- Profit-Taking by Major Investors: Many investors, including BitMEX co-founder Arthur Hayes, anticipated a post-election market correction and strategically offloaded their holdings.

How Does This Compare to Past Market Crashes?

While the current downturn may seem dramatic, it is far from the worst Bitcoin has endured. The 2014 Mt. Gox scandal, which saw 850,000 BTC vanish due to a hack, led to an 85% price drop and decimated 70% of trading volumes. Back then, the market lacked institutional backing and clear regulations.

Today, however, the landscape is much different. Institutional adoption, regulatory advancements, and the rise of structured financial products have provided a safety net that did not exist a decade ago. Experts like Brett Reeves of BitGo believe these structural improvements mean the market is better equipped to weather downturns.

What’s Next for Bitcoin?

Despite the current dip, history suggests that severe corrections are often followed by consolidation phases and new price surges. Some analysts, like Miles Deutscher, argue that the traditional concepts of bull and bear markets are becoming obsolete as the crypto sector evolves.

Mati Greenspan, founder of Quantum Economics, believes this correction could be beneficial in the long run. He points out that this is the first crypto bull market not driven by excessive monetary stimulus, indicating a more organic market growth.

While Bitcoin’s 18% drop has shaken some investors, it is far from the catastrophic crashes seen in previous years. With increasing institutional involvement and improved regulatory frameworks, this correction may simply be a temporary phase before the next surge. The real question remains: is this a buying opportunity or a warning sign of further declines to come? Only time will tell.