- Bitcoin is nearing a new all-time high, driven by exchange outflows, rising retail interest, and potential geopolitical easing between the U.S. and China.

- However, overbought RSI levels and heightened investor greed suggest a short-term pullback could occur.

Bitcoin (BTC) has once again captured the spotlight, soaring past the $104,000 mark on May 9 before stabilizing near $103,000—a 33% gain over the past month. As excitement builds across crypto communities, several key indicators suggest that a new all-time high (ATH) could be closer than many think.

ALSO READ:Will Dogecoin Reach $1? Elliott Wave Analysis Predicts Major Breakout

Exchange Outflows Signal Strong Hands

A major bullish factor behind bitcoin’s price momentum is the ongoing trend of negative exchange netflows. This means more BTC is being withdrawn from exchanges than deposited, often interpreted as a sign that investors prefer holding their assets in private wallets rather than selling them. Reduced selling pressure is a classic indicator of confidence in further price appreciation.

Bitcoin Retail Interest Surges

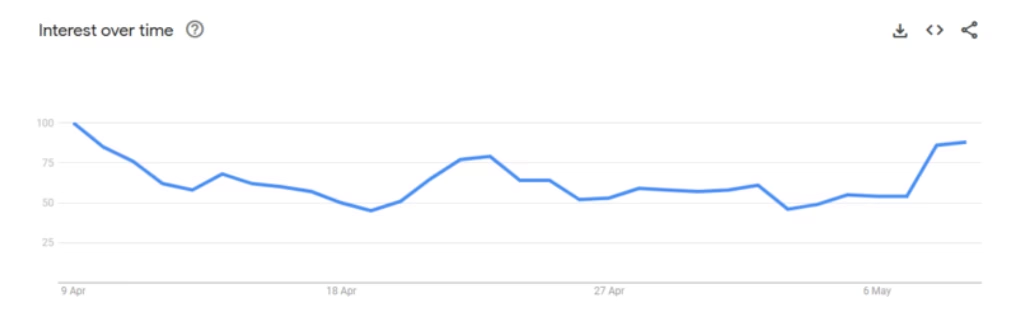

Retail investors are returning to the market. Google search data shows a notable increase in the term “bitcoin,” reflecting growing mainstream interest. Adding fuel to the rally, bitcoin’s network recorded almost 350,000 new wallets created in a single day. While this signals rising demand and FOMO (fear of missing out), current retail activity is still below what’s typically seen at market cycle tops—indicating there may be more room to run.

Geopolitical Tailwinds on the Horizon

An upcoming meeting between U.S. and Chinese officials could also provide indirect support for BTC. Talks aimed at de-escalating the ongoing trade war, including possible tariff reductions, might ease macroeconomic tensions. A reduction in global financial uncertainty could enhance investor confidence across both traditional and crypto markets.

ALSO READ:Pi Coin Explodes 13% as 5 Billion Token Shock Hints Binance Listing

A Word of Caution: RSI and Greed Levels

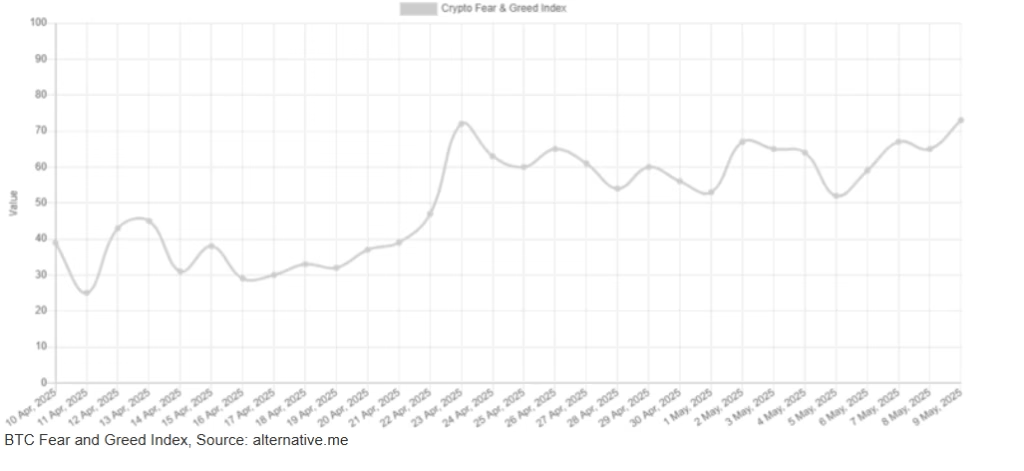

Despite the optimism, investors should stay alert. The Relative Strength Index (RSI) for bitcoin now hovers around 75—above the 70 threshold that often signals overbought conditions. Additionally, the Fear & Greed Index has climbed to 73, deep into “greed” territory. This level of sentiment, last seen in January, typically precedes at least short-term pullbacks.

While short-term volatility remains a possibility, the combination of reduced exchange supply, increased retail interest, and positive macro signals paints a bullish picture for bitcoin. If the current momentum holds and geopolitical news aligns, the market could soon witness a historic breakout. Still, as the legendary Warren Buffett warns, “Be fearful when others are greedy.”

DISCLAIMER:

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.