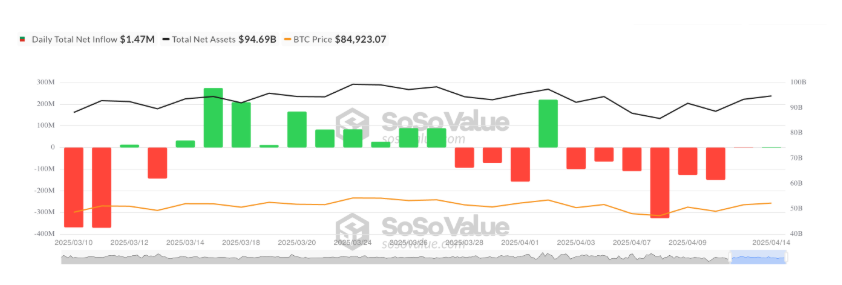

- Bitcoin ETFs saw a modest $1.47 million in inflows on April 14, ending a seven-day outflow streak and signaling renewed institutional interest.

- Despite cautious sentiment in the options market and increased bearish positions in the futures market, the uptick in ETF inflows suggests a potential shift in market sentiment.

Bitcoin funds have experienced a glimmer of hope after a seven-day streak of outflows, signaling renewed institutional interest. On April 14, US-listed Bitcoin ETFs saw $1.47 million in inflows, breaking a two-week dry spell. While the amount may seem small, it marks a crucial shift in sentiment toward Bitcoin exposure through regulated funds.

The Resurgence of Institutional Interest

After struggling to attract new capital for weeks, Bitcoin ETFs are showing signs of life. The April 14 inflows represent the first time since April 2 that funds have seen positive movement. BlackRock’s IBIT led the charge, drawing a substantial $36.72 million, while Fidelity’s FBTC experienced a notable $35.25 million outflow on the same day.

This change comes after a period of uncertainty in the broader cryptocurrency market, including a rough week in which Bitcoin funds recorded $713.30 million in net outflows. The challenging market conditions were largely driven by growing concerns over trade tensions, particularly surrounding Donald Trump’s rhetoric on tariffs. However, the tide appears to be shifting, with institutional investors once again showing a renewed appetite for Bitcoin ETFs.

Rising Activity in Bitcoin Derivatives

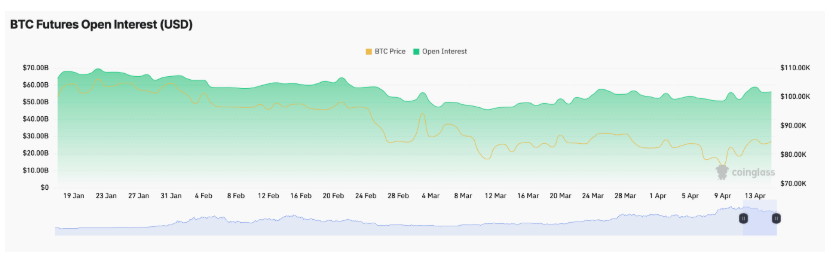

Alongside the modest inflows into Bitcoin spot ETFs, the futures market has also been heating up. Bitcoin’s futures open interest rose by 2%, reaching $56 billion, signaling a surge in derivatives activity. This uptick suggests that new money is entering the market, potentially fueling bullish momentum.

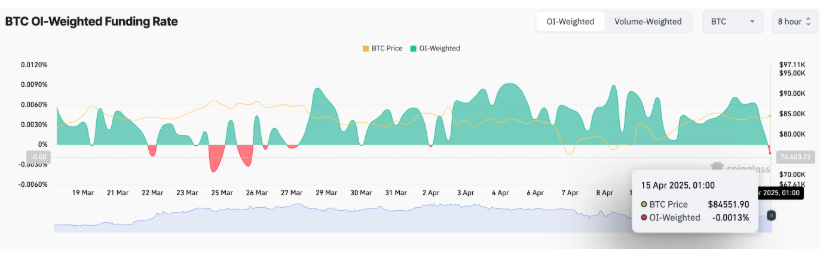

Despite the increase in futures contracts, the nature of these new positions indicates caution. The funding rate for BTC futures has flipped negative for the first time since April 2, indicating that more traders are holding short positions. This shift in sentiment suggests a growing belief that a potential pullback could be on the horizon.

A Cautious Outlook for Bitcoin

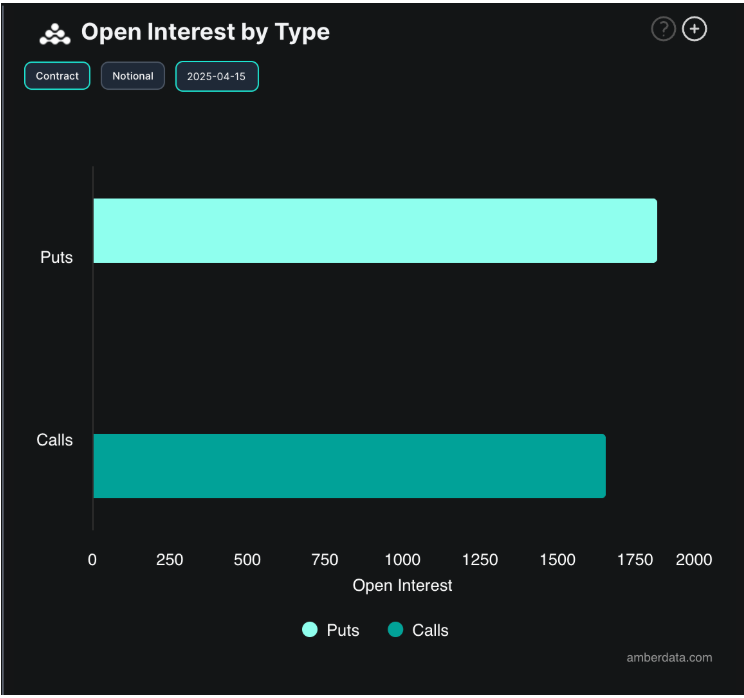

While the increase in Bitcoin ETF inflows and the rise in futures open interest point to a positive trend, the mood remains cautious in other areas of the market. The options market, for example, shows more put contracts than calls, suggesting that traders are hedging against further downside risks.

Still, the modest return of capital to Bitcoin ETFs, after weeks of silence, signals that institutional investors may be testing the waters again. Whether this renewed interest in Bitcoin will sustain through the week remains to be seen, but for now, it offers a ray of hope in an otherwise turbulent market.

DISCLAIMER:

The views and opinions expressed herein are solely those of the author or advertiser and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.