- Bitcoin miners sold over 16,000 BTC in July, yet the market remained stable thanks to growing institutional demand and maturity.

- This strategic profit-taking highlights the resilience of the current bull market and rising interest in innovative projects like Bitcoin Hyper.

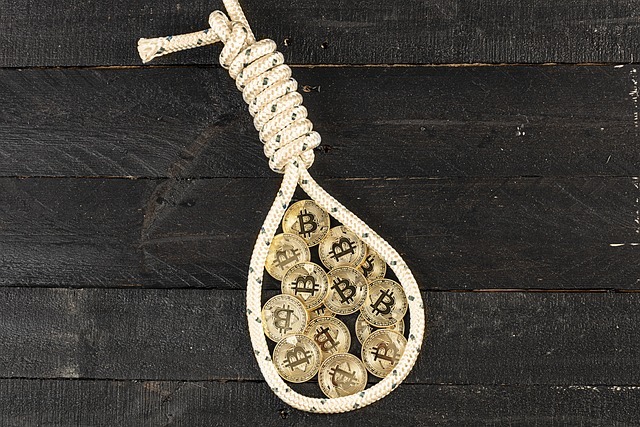

Bitcoin miners sold over 16,000 BTC in July, the highest monthly outflow since March, representing more than $1.8 billion in value. While this has stirred concerns, the market’s calm response points to a more mature, resilient bull cycle.

Profit-Taking, Not Panic

Miners are cashing out at all-time highs, with bitcoin recently hitting $118,000. Rather than reacting out of fear, miners are managing risk, considering the recent halving of block rewards and increased operational costs. This shift signals strategic financial planning—not a retreat.

Importantly, the sell-off has been gradual. The market absorbed these sales with little disruption. Bitcoin briefly dipped below $115,000 but bounced back quickly. Strong inflows from spot ETFs and institutional buyers helped stabilize the price, showing that the demand side remains strong.

Healthy Market Behavior

Market analysts agree: this kind of selling activity isn’t a red flag. In fact, it reflects a more rational, developed market. Miners, who earn in BTC, are naturally inclined to sell when prices soar. This liquidity creation is a sign of market strength, not weakness.

Moreover, the broader sentiment has shifted from volatile emotion to thoughtful engagement. Investors understand the long-term opportunity and remain active participants. With increased adoption, stronger infrastructure, and institutional backing, bitcoin’s current bull run has firmer ground than ever before.

Bitcoin Hyper Signals a Fresh Direction

Amid this evolving landscape, new projects are emerging to meet shifting investor interests. One standout is Bitcoin Hyper, which has raised over $4 million in its presale. Built on the Solana Virtual Machine, Bitcoin Hyper offers low fees, fast transactions, and strong community focus—qualities that resonate in a fast-paced market.

Bitcoin Hyper moves away from institutional complexity and leans into culture, accessibility, and user experience. As investors look for the next breakthrough, projects like this blend familiarity with innovation, offering fresh crypto opportunities.

Miners selling BTC doesn’t spell the end of the bull market—it highlights a more balanced, strategic ecosystem. With fresh projects entering the scene and seasoned players making calculated moves, Bitcoin’s growth remains strong, stable, and increasingly sophisticated.