- Bitcoin dropped to $112,600, triggering retail panic selling and the most bearish sentiment since June.

- Analysts suggest the fear could signal a buying opportunity, as past bull cycles show similar corrections before major rallies.

Bitcoin’s latest dip to $112,600 has sparked panic among retail traders, who swiftly flipped from bullish to what analysts are calling “ultra bearish.” Despite the negativity, market experts argue that the current downturn may present a major buying opportunity for long-term investors.

Retail Bitcoin Traders Fuel Fear in the Market

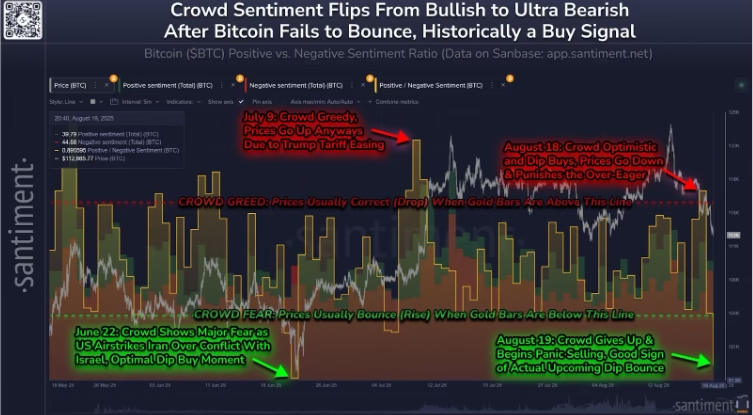

According to blockchain analytics firm Santiment, retail sentiment has undergone a complete reversal after Bitcoin failed to recover from its recent decline below $113,000. The past 24 hours marked the most bearish mood on social media since late June, when geopolitical fears triggered widespread panic selling.

Source: Santiment

Santiment notes that short-term traders are far more likely to exit positions in fear, while long-term holders—often referred to as having “diamond hands”—see downturns as chances to accumulate. Historically, such spikes in fear have often preceded strong rebound rallies.

Bitcoin Tests Key Support Levels

Bitcoin slid to a 17-day low of $112,656 on Coinbase, marking an 8.5% retreat from its recent record high above $124,000. The decline also pushed total crypto market capitalization below $4 trillion for the first time in two weeks.

Meanwhile, the Bitcoin Fear & Greed Index dropped to 44 out of 100, placing the market firmly in “Fear” territory. Analysts suggest this contrarian signal could favor patient buyers, as markets often move against majority sentiment.

Could This Be Another Bull Cycle Correction?

Corrections during bull cycles are not new for Bitcoin. In 2017, the cryptocurrency shed 36% in September before rallying to fresh highs by December. Similarly, in 2021, Bitcoin dropped 23% in September before staging another record-breaking surge.

Source: Cyclop

If patterns from past bull runs repeat, analysts believe BTC could slide further—possibly toward $90,000—before bouncing to new all-time highs later this year. Such scenarios underscore that short-term fear may give way to long-term opportunity.

While retail traders panic, seasoned investors are eyeing the pullback as a potential accumulation phase. Market history suggests that corrections, though sharp, often pave the way for stronger rallies ahead. For those who can weather volatility, the “ultra bearish” sentiment may be less a warning sign and more a signal of what comes next.

DISCLAIMER:

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.