- Bitcoin has fallen to $115,000 as investors shift focus to Ethereum, which is experiencing a strong breakout.

- While Bitcoin cools off from its recent high, Ethereum has surged over 50% in a month and could hit $10,000 by year-end.

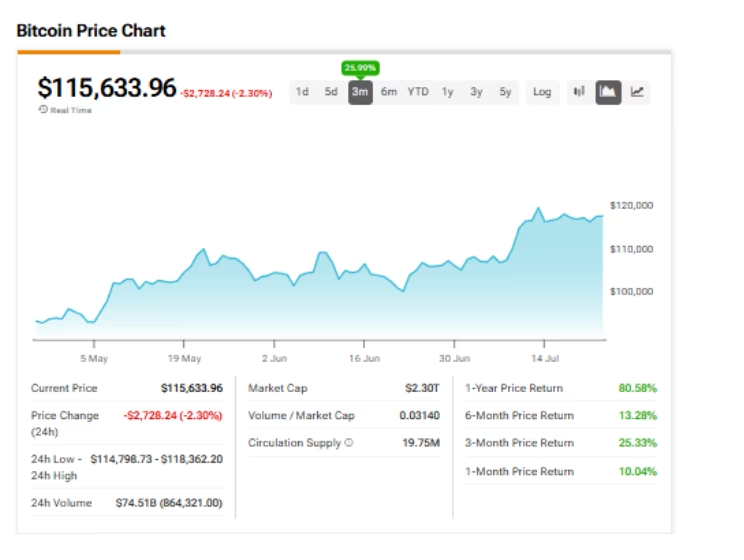

Bitcoin’s recent decline to $115,000 has caught the attention of investors, especially as institutional money continues to rotate into Ethereum. After hitting a record high of $123,000 earlier in July, the world’s largest cryptocurrency is now in correction mode—something analysts view as a typical cool-off period following a major rally.

Ethereum’s Rise as Bitcoin Pulls Back

Bitcoin is now hovering near a critical resistance level at $115,000, and some bearish voices in the market predict it could fall back to its previous all-time high of $111,000. This kind of retesting has historically occurred after BTC rallies, but so far, that hasn’t happened in this cycle. Instead, the correction is coinciding with a noticeable shift in investor focus—away from Bitcoin and toward Ethereum.

Ethereum has been enjoying a breakout of its own. Currently trading at $3,600, ETH has surged more than 50% over the past month. This performance has put it at the highest level it has seen all year. Analysts are now boldly projecting that Ethereum could reach between $8,000 and $10,000 by the end of the year, further encouraging the flow of funds into the network.

What’s Behind the Rotation?

The rotation from Bitcoin into Ethereum seems to be both technical and strategic. Ethereum’s recent gains are sparking excitement among traders looking for the next big play, while Bitcoin is experiencing typical consolidation. Despite its recent slump, BTC is still up around 24% year-to-date and has gained nearly 26% over the last 12 weeks, showing resilience in the bigger picture.

August, historically a weak month for cryptocurrencies, could be adding to the market’s cautious tone. Investors may be waiting for clearer signs before making bigger moves, especially in Bitcoin, which is currently struggling to regain bullish traction.

Is Bitcoin Still a Buy?

Although traditional Wall Street firms don’t offer ratings on Bitcoin, its three-month performance suggests the asset is still in a long-term uptrend. The recent dip may simply be a healthy pause, rather than a major reversal. For investors watching closely, this pullback could present an opportunity—depending on whether Bitcoin can hold above $111,000 in the coming weeks.

DISCLAIMER:

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.