- Bitcoin’s recent drop to $59,000 is driven by regulatory scrutiny, institutional pullback, and whale selloffs, creating market uncertainty.

- Future price movements could see BTC either rebound to $70,000 or fall further to $50,000, depending on upcoming economic data and market reactions.

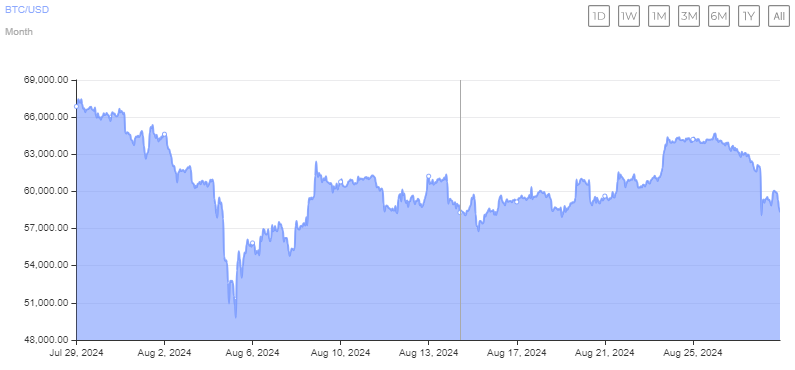

Bitcoin (BTC) has recently experienced a significant downturn, plummeting to $59,000, sparking concerns and speculations across the crypto community. The sharp decline in BTC’s value can be attributed to a combination of factors, including increased regulatory scrutiny, reduced institutional participation, and strategic selloffs by cryptocurrency whales. As the market grapples with uncertainty, the question on everyone’s mind is: Will Bitcoin drop further to $50,000, or can it rebound to $70,000?

The Drivers Behind Bitcoin’s Decline

The recent drop in Bitcoin’s price can be traced back to three key factors:

- Regulatory Scrutiny: Governments and financial regulators worldwide have intensified their focus on the cryptocurrency sector, aiming to establish stricter controls and frameworks. This heightened scrutiny has unsettled investors, leading to a sell-off and subsequent drop in Bitcoin’s price.

- Institutional Withdrawal: After a period of strong institutional investment in Bitcoin, some large players are beginning to pull back. This withdrawal is partly due to the uncertain regulatory environment and concerns over the long-term sustainability of current market valuations. As institutions reassess their positions, Bitcoin’s price has been left vulnerable to downward pressure.

- Whale Selloffs: A significant factor contributing to the recent plunge was a whale’s decision to move 2,300 BTC, valued at approximately $141.81 million, to the Kraken exchange. This massive selloff created additional market pressure, triggering further declines in Bitcoin’s value.

What’s Next for Bitcoin?

With Bitcoin currently hovering around the $59,000 mark, the market remains in a state of flux. The next price movement could be influenced by upcoming economic data and market reactions to earnings reports from tech giants like NVIDIA. Additionally, the anticipated release of the U.S. PCE inflation data could further sway investor sentiment.

Despite the recent dip, there is still a possibility for a rebound. Analysts suggest that if Bitcoin can break through a critical resistance level, it could rally back to $65,000 or even $70,000. However, if the cryptocurrency fails to recover to the $61,000 threshold, it risks a further drop to $50,000 or lower.

The Market’s Uncertain Path

As traders and investors remain cautious, Bitcoin’s future trajectory is uncertain. The recent downturn has led to a drop in BTC futures open interest and a surge in trading volume, indicating heightened volatility. If the market does not find a clear direction soon, Bitcoin could face further declines, with $48,000 being a potential support level to watch closely.

Bitcoin’s price movement in the coming weeks will be crucial in determining its short-term future. Whether it rebounds or continues to fall, the market will be closely monitoring regulatory developments, institutional actions, and the behavior of major holders in the crypto space.