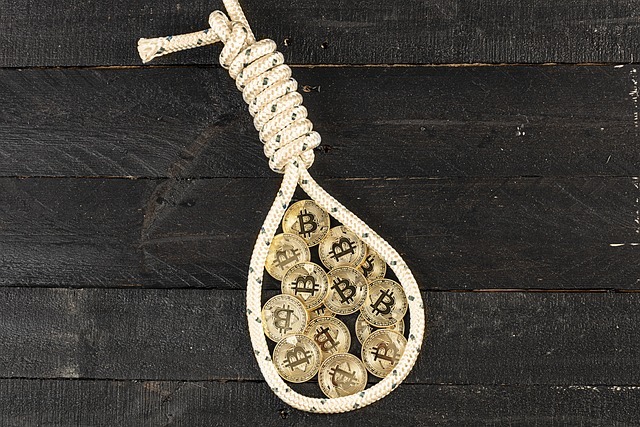

- Bitcoin’s 6.3% drop, triggered by the recent ETF approval, has set off a market sell-off, impacting Ethereum and Dogecoin.

- The anticipated influx of new money into the crypto market following the ETF approval has yet to materialize, leading to increased volatility and concerns about speculative trading.

Cryptocurrency investors were anticipating a significant boost with the approval of a Bitcoin ETF, only to find themselves on a wild ride as Bitcoin plummeted by 6.3% in the last 24 hours, triggering a domino effect on Ethereum and Dogecoin.

The Ripple Effect

Despite months of anticipation leading up to the ETF approval, the market reaction was contrary to expectations. Bitcoin’s decline, currently standing at 6.3%, accelerated early in the day, resulting in Ethereum losing 3.7% and Dogecoin experiencing a 3.9% drop in just a few hours.

The cryptocurrency community had embraced the rumor of the ETF approval, but when the news finally materialized on January 10, the market responded with a sell-off. Investors who had eagerly bought in anticipation of the ETFs now found themselves in a sell-the-news scenario.

Tech Turmoil

Cryptocurrencies don’t exist in isolation, and their fate often intertwines with high-growth tech stocks. Today’s market turmoil extends beyond the crypto realm, with layoffs reported at major tech companies, raising concerns about the anticipated growth in 2024. The realization that growth is slowing down and costs need to be reined in has hit the tech industry hard.

While this tech turbulence doesn’t directly impact cryptocurrencies, the historical correlation between cryptocurrency and high-growth tech stocks explains the sell-off in the crypto market.

ETF Approval Dilemma

The theory surrounding the recent months in the crypto space suggested that the ETF approval would usher in new buyers and billions of dollars into the market. However, this expectation appears to be waning.

Cryptocurrency accessibility has grown significantly in recent years, making the need for an ETF less compelling. Additionally, the associated fees with ETFs may deter potential investors when they can easily hold cryptocurrencies in self-custody.

The Road Ahead

As the market digests the aftermath of ETF approvals and distinguishes between long-term investors and those merely speculating, this week’s heightened volatility might persist. The theme for the coming weeks could revolve around whether the recent sell-off is a temporary setback or indicative of a more prolonged downturn in the crypto market.