- The concept of Bitcoin halving is a process that reduces the reward for mining new bitcoins by half approximately every four years.

- It discusses the potential impact of halving on Bitcoin’s price, investor sentiment, and provides recommendations for navigating the cryptocurrency market amidst its volatility.

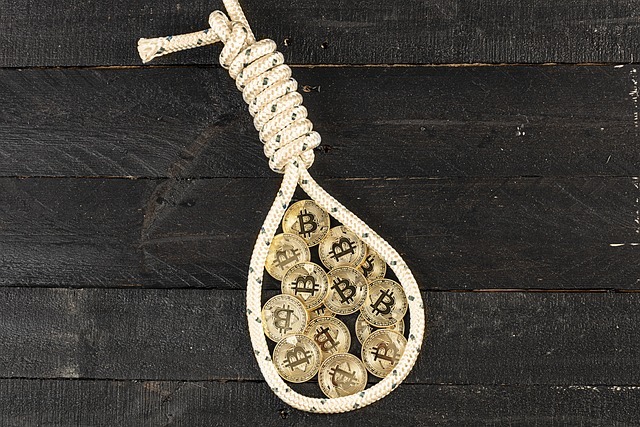

Bitcoin has been on a rollercoaster ride of value over the past few years, attracting both enthusiastic investors and wary skeptics. The cryptocurrency’s recent surge, driven in part by the approval of spot bitcoin ETFs, has reignited discussions about its future trajectory. However, another event looming on the horizon could have significant implications for its price: the halving.

Understanding Bitcoin’s Halving

Halving is an automatic process that occurs approximately every four years as part of the bitcoin mining protocol. When 210,000 “blocks” are mined, the reward for mining new bitcoin is halved. This mechanism, designed to mimic the scarcity of precious metals like gold, aims to slow the production of new coins as bitcoin approaches its total supply cap of 21 million coins.

The next halving event is anticipated to take place sometime in April, following the previous one in 2020. Each halving historically triggers a surge in bitcoin’s value shortly thereafter, as the reduced supply fuels demand and drives up prices.

The Impact on Price and Investor Sentiment

Financial experts, such as Douglas Boneparth, president of Bone Fide Wealth, anticipate that the halving will lead to increased prices due to constrained supply. However, some argue that the effects of halving may already be factored into bitcoin’s current price, especially with the recent introduction of spot ETFs.

Institutions are expected to increase their bitcoin holdings to support the inflow into these funds, potentially further influencing prices. Despite the anticipation of price increases, it’s essential to remember that bitcoin remains a highly speculative asset, prone to significant volatility. Past performance is not indicative of future results, and there are no guarantees of retaining value.

Investing in Bitcoin: Risks and Recommendations

While some experts suggest allocating a small portion of a diversified investment portfolio to cryptocurrencies, it’s crucial to approach such investments with caution. Chris Diodato, a CFP and founder of WELLth Financial Planning, advises limiting cryptocurrency exposure to around 1% to 2% of the portfolio due to its inherent risks.

Unlike traditional investments like stocks or bonds, bitcoin does not represent ownership in a physical asset or future earnings. Its value is solely determined by market demand and sentiment. Therefore, investors should weigh the potential returns against the considerable risks associated with cryptocurrency investments.

While the halving event may contribute to short-term price fluctuations, investors should approach bitcoin with careful consideration and diversify their portfolios to mitigate risks. As with any investment, thorough research and understanding of the market dynamics are essential to making informed decisions.