- Bitcoin is still projected to reach $1.8 million by 2035 despite recent market volatility and investor caution driven by global trade tensions.

- Analysts remain optimistic about its long-term growth, especially as it moves closer to rivaling gold’s $21 trillion market cap.

Bitcoin may be experiencing a rocky 2025, but analysts believe the long-term path still leads to unprecedented highs. Joe Burnett, Director of Market Research at Unchained, recently reiterated his bold forecast: Bitcoin could surge past $1.8 million by 2035.

Despite recent price dips and shifting investor sentiment due to global trade tensions, Burnett maintains that Bitcoin remains in a “long-term bullish cycle.” Speaking during Cointelegraph’s Chainreaction show on X, he compared Bitcoin’s trajectory to the historic shift from horse-drawn carriages to automobiles, saying the transition to Bitcoin as a superior asset is only a matter of time.

🎙Could Bitcoin really hit $10m by Q1 2035? Perhaps.

— Cointelegraph (@Cointelegraph) April 11, 2025

But first, we need to unravel the tangled web of the markets this week, and for both discussions, @rkbaggs and @gazza_jenks are joined today by Joe Burnett (@IIICapital) on the #CHAINREACTION show! https://t.co/hfyEwGUCsh

A Glimpse Into the Future: Bitcoin and Gold Parity

Burnett highlighted two models that support Bitcoin’s explosive potential over the next decade. The first, known as the “parallel model,” places Bitcoin at $1.8 million by 2035. The second, Michael Saylor’s “Bitcoin 24 model,” pushes that number even higher to $2.1 million.

Both projections are grounded in the idea of Bitcoin reaching or surpassing gold’s $21 trillion market cap. “If Bitcoin hit gold parity today,” Burnett said, “we’d be talking about $1 million per coin.” With Bitcoin’s technological edge and increasing mainstream adoption, he argues this scenario is more realistic than many realize.

Market Jitters and Gold’s Temporary Reign

However, short-term headwinds remain. Trade tensions — reignited by aggressive tariff threats from U.S. leadership — have driven risk-averse behavior among investors.

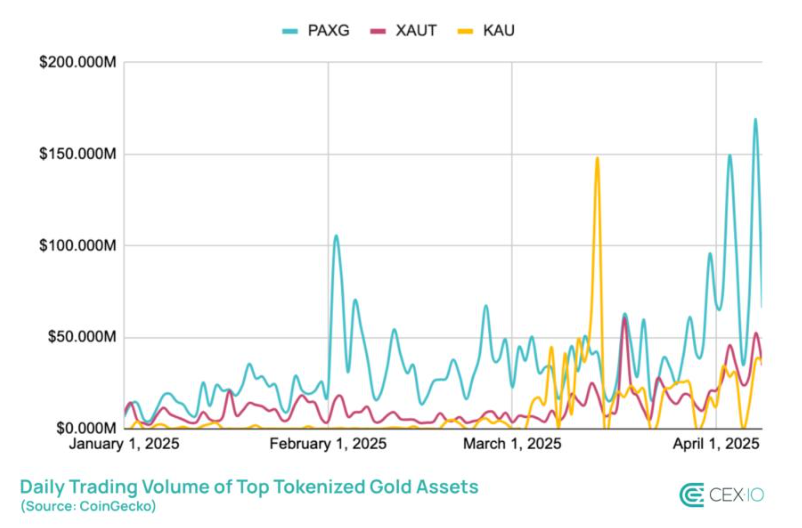

Gold and tokenized gold have surged in popularity, with tokenized gold volumes hitting $1 billion this week, the highest since the 2023 U.S. banking crisis.

Since the start of 2025, gold is up over 23%, while Bitcoin has dropped more than 10%. As Enmanuel Cardozo of Brickken notes, investors are currently rebalancing toward safer assets, with many avoiding major moves until global markets stabilize.

Strong Hands, Stronger Future

Still, Burnett views Bitcoin’s pullbacks as strategic entry points for long-term believers. “The deep, dark bear markets move coins into the hands of the strongest, most convicted holders,” he explained. These moments, he argues, are when Bitcoin’s future gets solidified.

With experts like Arthur Hayes predicting Bitcoin could hit $250,000 by the end of 2025 under a looser Fed policy, the stage is set for a potentially historic bull run — if investors can stomach the wait.

DISCLAIMER:

The views and opinions expressed herein are solely those of the author or advertiser and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.