- BlackRock’s Bitcoin ETF (IBIT) has recorded 15 straight days of inflows, adding 5,613 BTC worth $530 million on Monday alone, signaling strong institutional interest.

- With BTC holding around $94,500 and market indicators resetting, continued ETF inflows could soon push the price toward the $100K mark.

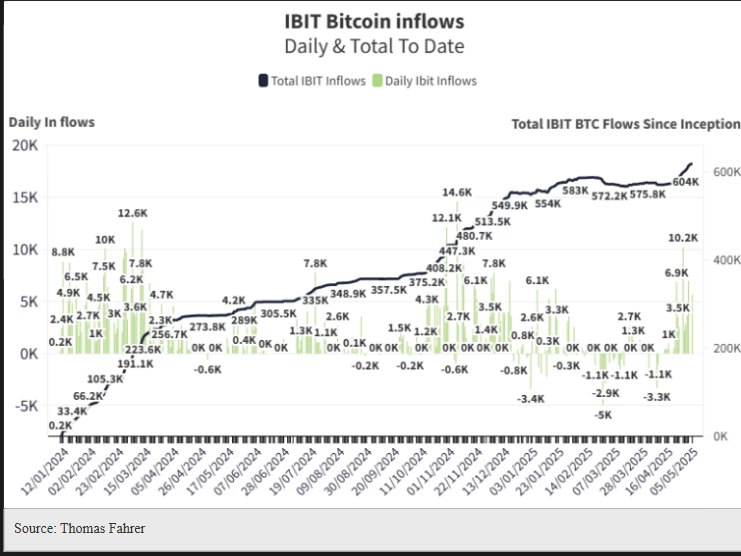

Bitcoin appears poised for another major price rally as institutional investors double down on their exposure, with BlackRock’s iShares Bitcoin Trust (IBIT) leading the charge. The ETF recorded inflows of 5,613 BTC worth $530 million on Monday alone, marking 15 consecutive days of accumulation—its most aggressive buying streak to date.

BlackRock’s Relentless Accumulation Signals Institutional Confidence

Since its inception, BlackRock’s IBIT has amassed over $44 billion in inflows, and recent activity suggests that appetite is far from waning. In the first quarter of this year, BlackRock boosted its stake in the ETF by 124%, bringing its total investment to $314 million. This aggressive move underlines growing institutional confidence in Bitcoin amid shifting market dynamics.

While overall Bitcoin ETF inflows hit $425 million on Monday, BlackRock’s IBIT alone contributed more than the total, outpacing competitors like Fidelity’s FBTC and Grayscale’s GBTC, which both recorded outflows. Bloomberg’s ETF strategist Eric Balchunas highlighted IBIT’s rise, noting it now ranks 8th in year-to-date flows, having re-entered the top 10 after being previously outside the top 50.

BTC Price Holds Steady, But Indicators Point to a Surge

Bitcoin is currently trading around $94,500, consolidating after recent volatility. Yet, underlying market metrics suggest that a bigger move could be brewing. The Market Value to Realized Value (MVRV) ratio has returned to its long-term mean of 1.74—a sign that excess speculation has been flushed out.

Crypto analyst Kyledopps describes the current phase as a “clean reset,” hinting at an optimal environment for a fresh upward leg. If the trend continues, Bitcoin could be on track to reclaim and possibly surpass the $100K mark, a level that’s become a key psychological and technical milestone.

Inflows Could Be the Catalyst for the Next Bull Leg

With BlackRock “hoovering up BTC like a madman,” according to Balchunas, and the overall market showing signs of stabilization, all eyes are now on whether sustained ETF inflows can tip the scale. The CoinGape Bitcoin price prediction model suggests BTC may hover around $94,600 in the near term, but consistent demand from large institutional players could accelerate the breakout.

If BlackRock maintains this momentum, Bitcoin’s path to $100K may be shorter than many expect.

DISCLAIMER:

The views and opinions expressed herein are solely those of the author or advertiser and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. We encourage readers to conduct further research and consult additional sources before making any decisions based on this content.