- Brazil’s National High Court has ruled that cryptocurrency assets can be seized to settle debts, allowing judges to issue orders to exchanges for asset investigations.

- This historic decision acknowledges cryptocurrencies as taxable assets and paves the way for their integration into traditional legal systems, despite operational challenges in asset seizure.

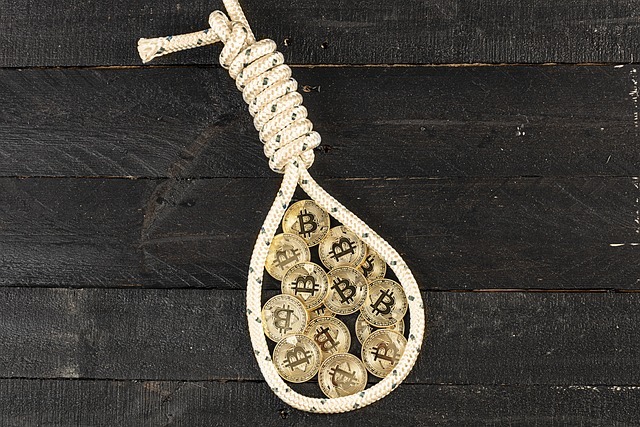

Brazil’s National High Court has made a groundbreaking decision that brings cryptocurrencies under the scrutiny of the judicial system in the context of debt recovery. In a historic ruling, the court has paved the way for debtors’ digital assets to be seized directly from cryptocurrency exchanges, marking a significant step in the integration of digital currencies into traditional legal frameworks.

The Decision: A Major Shift in Debt Recovery

In the past, creditors facing debtors who stored their funds in cryptocurrency had limited options. Traditional methods of debt recovery, like bank account seizures, were ineffective when the debtor kept their wealth in digital currencies. However, Brazil’s National High Court (STJ) has now clarified that judges can issue direct orders to cryptocurrency exchanges to investigate whether a debtor holds crypto assets. If such assets are found, they can be seized just as traditional assets are in debt recovery cases.

This decision was made on the premise that cryptocurrencies, while not recognized as legal tender, are still valuable assets and are subject to taxation. These digital assets must be reported to the Federal Revenue Service in Brazil, which supports the idea of them being a store of value and a legitimate form of payment.

Challenges in Seizing Cryptocurrency Assets

While the ruling sets a precedent, it acknowledges the complexities involved in seizing cryptocurrency. Unlike bank accounts, digital assets can be transferred across different exchanges or even stored in private wallets, making them more difficult to trace. The court noted these challenges and emphasized that a new system is already being developed to make the process of searching for and seizing cryptocurrency assets more efficient and effective.

This new system will likely streamline the process, enabling quicker identification of crypto holdings and faster asset seizure. While this system is still in the works, it highlights the judicial system’s commitment to keeping up with technological advancements.

What This Means for the Future of Cryptocurrency in Brazil

This ruling not only affects debtors and creditors but also sends a strong message about the growing importance of cryptocurrency in the financial landscape. As cryptocurrencies continue to gain recognition as legitimate assets, this decision could encourage more countries to integrate crypto into their legal systems, especially concerning issues like taxation and debt recovery.

For now, Brazil’s legal system has set a precedent for how cryptocurrency will be handled in the context of financial disputes, with a clear path forward for further regulation and system enhancements. The integration of cryptocurrency into the judicial system marks a new era for both digital assets and their place in the global financial order.