- Grayscale transfers $292.4 million in Bitcoin to Coinbase amidst record outflows from cryptocurrency investment funds, driven by investor concerns over falling prices and high fees.

- Despite challenges, experts remain cautiously optimistic, noting nascent institutional engagement efforts amid global market volatility.

Grayscale has transferred 4300 Bitcoin (equivalent to $292.4 million) to Coinbase. This significant transfer comes amidst a tumultuous period marked by record outflows from digital asset investment products, including Grayscale’s owned Bitcoin exchange-traded fund (ETF).

The past week witnessed a staggering $2 billion bleed from investment funds holding digital assets, largely attributed to plummeting crypto prices and investor concerns regarding high fees associated with Grayscale’s offerings. This downturn interrupted a seven-week streak of inflows, totaling $12.3 billion, with Grayscale’s GBTC leading the exodus with nearly $2 billion in outflows.

Notably, Ethereum and Solana investment products also experienced outflows, amounting to approximately $34 million and $5.6 million, respectively, according to a CoinShares report. However, the tide turned for other US-based Bitcoin ETFs, which collectively garnered over $1.1 billion in inflows, effectively offsetting the departures from Grayscale’s GBTC.

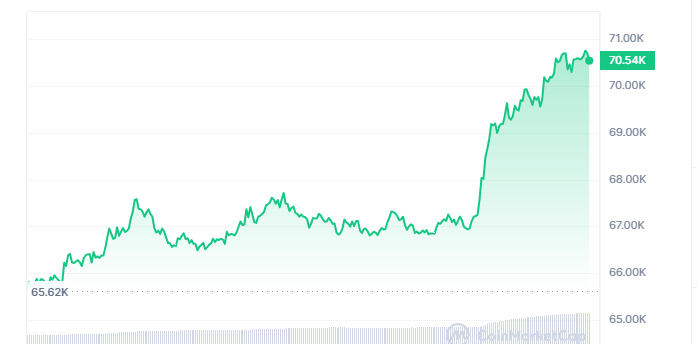

Bitcoin Price

At the time of press, Bitcoin is trading at $70,683, a 7% price surge in the last day. This is a 5% increase in the last week as the coin looks to register another ATH.

Experts Navigate Cryptocurrency Market Volatility Amidst Global Investor Hesitancy

James Butterfill, CoinShares’ head of research, attributed the recent drop in crypto prices to investor hesitancy, resulting in subdued inflows into new ETF issuers in the US. Kelly Ye of Decentral Park echoed this sentiment, noting that negative price action likely drove the first week of spot ETF outflows since January.

Despite these challenges, industry experts remain optimistic, highlighting the nascent stage of institutional client engagement efforts. Butterfill emphasized that the poor sentiment extended beyond the US, with countries like Sweden, Switzerland, Hong Kong, and Germany witnessing significant outflows.

However, amidst this global landscape of uncertainty, Brazil and Canada emerged as beacons of inflows, each attracting around $9 million, respectively. This divergence underscores the nuanced dynamics at play within the cryptocurrency market, where sentiment can vary greatly across regions and investment products.

Grayscale’s substantial Bitcoin transfer to Coinbase occurs against the backdrop of record outflows from cryptocurrency investment funds. While challenges persist, including market volatility and fee concerns, the resilience of certain investment vehicles and the ongoing pursuit of institutional engagement suggests a maturing ecosystem poised for continued evolution.