- Bitcoin has surged past $100,000, driven by over $40 billion in institutional inflows into ETFs and major purchases by firms like Metaplanet and Strategy.

- Growing adoption by U.S. states and asset managers signals a structural shift, with market data pointing toward sustained bullish momentum despite short-term volatility.

Bitcoin has soared past the $100,000 milestone once again, fueled by a wave of institutional investment that appears to be reshaping the cryptocurrency landscape. The digital asset was trading at $101,167.65 at the time of writing, marking a 4.66% gain in just 24 hours and a weekly increase of 3.91%, according to CoinMarketCap.

Institutional Inflows Drive Bitcoin Momentum

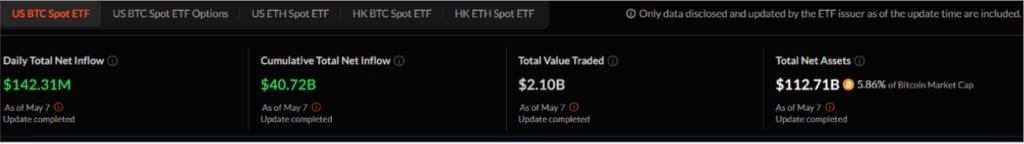

This rally mirrors a similar surge in early February, when bitcoin last crossed into six-figure territory shortly after reaching its all-time high of $109,114.88. A key driver this time is the unprecedented net inflows into spot bitcoin exchange-traded funds (ETFs), which have topped $40.72 billion. The significant capital injection highlights growing confidence from major financial institutions.

Leading the charge is Japanese treasury firm Metaplanet, which added 555 BTC on Wednesday, pushing its total holdings to 5,555 BTC. The company has set an ambitious target of 21,000 BTC by the end of next year. Meanwhile, Michael Saylor’s Strategy firm has amassed 555,450 BTC, now worth more than $56 billion.

U.S. States and Asset Managers Join the Frenzy

Notably, U.S. state governments are also getting involved. New Hampshire has become the first state to create a strategic bitcoin reserve, with Arizona following soon after. On the corporate front, Strive Asset Management is developing the first publicly traded bitcoin treasury asset management company, a move co-founded by former presidential hopeful Vivek Ramaswamy.

“The dominant story for bitcoin has changed again,” said Geoffrey Kendrick of Standard Chartered Bank. “It is now all about flows, and flows are coming in many forms.”

ALSO READ:Will Solana Hold $120 After Binance Dumps Millions in SOL

Market Metrics Reflect Growing Strength

Bitcoin’s trading volume surged by 41.12% to $62.38 billion, while its market capitalization hit a major milestone of $2 trillion. Despite this strength, BTC dominance dipped slightly to 64.77%, suggesting a modest shift of capital into altcoins.

Futures markets also responded with increased activity, as open interest climbed 6.39% to $68.88 billion. However, the bullish momentum came with turbulence. Long traders faced $1.55 million in liquidations over 24 hours, a reminder of the asset’s inherent volatility.

Kendrick remains bullish: “I think a fresh all-time high for bitcoin is coming soon. I apologise that my USD120k Q2 target may be too low.”

As institutions continue to pile in, bitcoin appears poised for a new chapter—one defined not just by speculation, but by structural financial adoption.

ALSO READ:XRP Price Flirts With $2 gaining 3.14% in the last day, Will Bulls Regain Control?

DISCLAIMER:

The views and opinions expressed herein are solely those of the author or advertiser and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.