- Chainlink price has surged over 58%, driven by strong whale buying and key technical breakthroughs.

- If the positive momentum continues and LINK holds above $18, it could reach $23 soon despite being slightly overbought.

Chainlink (LINK) is capturing market attention again, fueled by a surge in whale activity and promising technical signals. After a robust rally from $12.33 to $19.40—a gain of over 58%—investors are closely watching whether LINK can break through to the $23 mark this week.

Whale Activity Drives Chainlink Rally

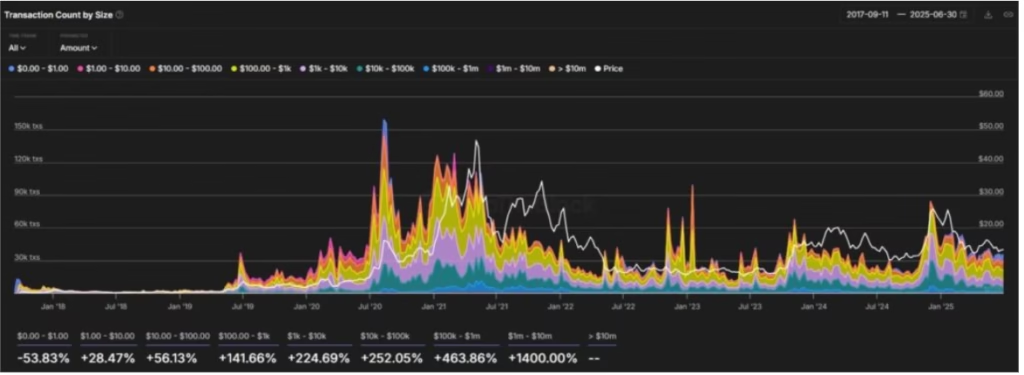

Large investors, commonly called whales, have been actively accumulating LINK tokens in recent weeks. Data shows these whales have bought over 8 million LINK tokens in the past month, a clear sign of growing confidence. This buying pressure has supported Chainlink’s price rebound and helped it overcome key resistance points, including a descending trendline and the significant $18 horizontal barrier that has historically influenced price movements.

Whales have bought over 8 million Chainlink $LINK in the past month! pic.twitter.com/9u29Kyx07p

— Ali (@ali_charts) July 19, 2025

Technical Setup Points to Potential Gains

Technical analysts from AMBCrypto highlight that Chainlink recently broke and retested a bullish double bottom pattern, a classic sign that the asset could be ready for further gains. If market sentiment remains favorable and LINK sustains its position above $18, a near 20% rise could push the price to $23 soon.

However, caution is warranted. The Relative Strength Index (RSI) for LINK is currently around 82, indicating an overbought condition. This often signals that a price correction might be imminent. Despite this, ongoing whale buying suggests that bulls still hold sway in the market.

What to Watch Moving Forward

As Chainlink enters a critical phase, investors should monitor several key factors:

- Whether LINK maintains above the $18 support level

- Continued whale activity and accumulation patterns

- Market sentiment and broader crypto trends

If these elements align positively, LINK’s breakout beyond $23 could become a reality in the coming weeks. Otherwise, a short-term pullback might provide a more sustainable path for the next leg up.

Chainlink’s recent surge, backed by significant whale interest and strong technical patterns, positions it well for further upside. Still, traders should stay alert to overbought signals and evolving market conditions before making bold moves.

DISCLAIMER:

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.