- Hyperliquid (HYPE) has dropped below $40, with sellers now targeting $37 and possibly $32.

- A bearish MACD crossover and consistent daily losses confirm growing downside pressure.

Hyperliquid (HYPE) has entered a sharp downtrend after losing its hold above the $40 mark. Sellers are now firmly in control, raising the risk of deeper declines in the days ahead. With technical signals flashing red and a critical support level in play, HYPE traders are bracing for more turbulence.

Resistance Turns Into a Wall

The $40 level, once a psychological and technical support, has flipped into a stubborn resistance. Hyperliquid’s failure to sustain gains above this threshold has emboldened bears, with the next target now set at $37. If this level gives way, the price may retreat further toward the $32 zone, which is expected to offer stronger support.

Four Red Candles Confirm Bearish Shift

In a clear display of bearish strength, HYPE has closed four consecutive daily candles in the red. This rare pattern indicates sustained selling pressure and lack of buyer confidence. With bulls sidelined, the cryptocurrency is sliding lower with limited resistance from buyers. A hold at $37 could offer short-term relief, but the overall sentiment remains pessimistic.

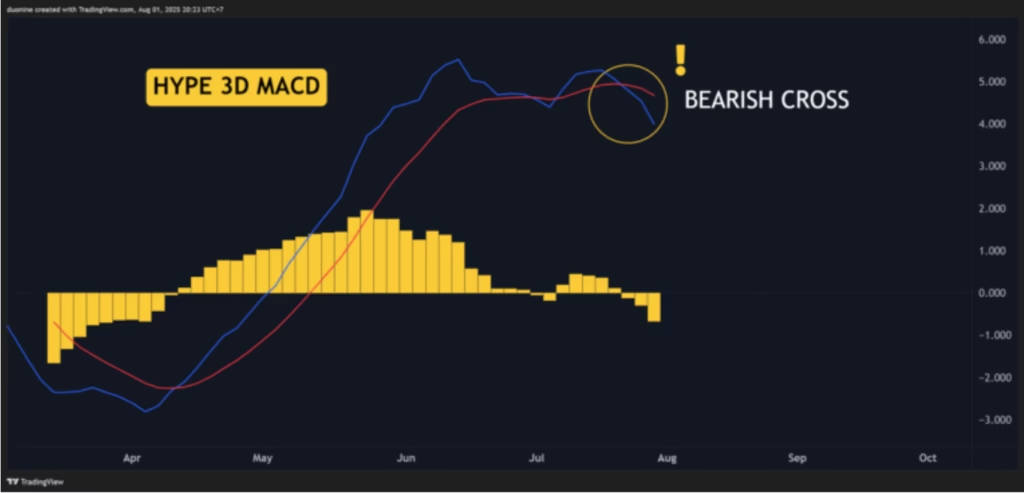

MACD Confirms Extended Correction

One of the strongest bearish indicators has just flashed — a major bearish crossover on the 3-day Moving Average Convergence Divergence (MACD) chart. This signal often precedes prolonged corrections and further price weakening. If this trend continues, HYPE may see a sustained move into the low $30s before any meaningful recovery begins.

What Comes Next for Hyperliquid?

The near-term outlook for Hyperliquid is bearish, and investors should monitor $37 closely as the next critical level. If support holds here, it might create a temporary base for recovery. However, a breakdown below this point could accelerate losses toward $32 or even lower. Until a shift in trend or a clear reversal pattern forms, caution remains key.

DISCLAIMER:

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.