- Hyperliquid drives HYPE to record highs with strong demand and ecosystem growth.

- But bearish signals and liquidation spikes hint at a possible reversal.

Hyperliquid’s native token, HYPE, has enjoyed a staggering 365% surge since April, hitting a new all-time high (ATH) of just over $44. However, recent technical and on-chain indicators suggest that this explosive rally may be losing steam as bearish sentiment begins to creep in.

Hyperliquid Faces Bearish Signals Despite Smart Money Support

Although whales and institutions have continued to inject liquidity into HYPE, warning signs are starting to surface.

The most notable is a price-RSI divergence—typically a strong signal that a correction is coming. Supporting this bearish outlook is the largest spike in long liquidations in six months, totaling $2.11 million on Friday alone. Meanwhile, short liquidations were significantly lower, hinting at a potential shift in sentiment.

Open interest has also hit a record high of $1.90 billion, and derivatives volume spiked to $3.3 billion on June 14, marking the highest daily figure for the token. While these metrics indicate strong engagement, they also highlight increased sensitivity to market swings. With such high leverage in play, smart money may find it profitable to trigger liquidations, potentially intensifying downside pressure.

Underlying Strength Could Limit the Damage

Despite bearish indicators, HYPE continues to benefit from strong fundamentals. The Hyperliquid ecosystem is thriving. Stablecoin liquidity peaked at $3.88 billion last week, and total value locked (TVL) in its layer 1 network reached $1.795 billion—both record highs.

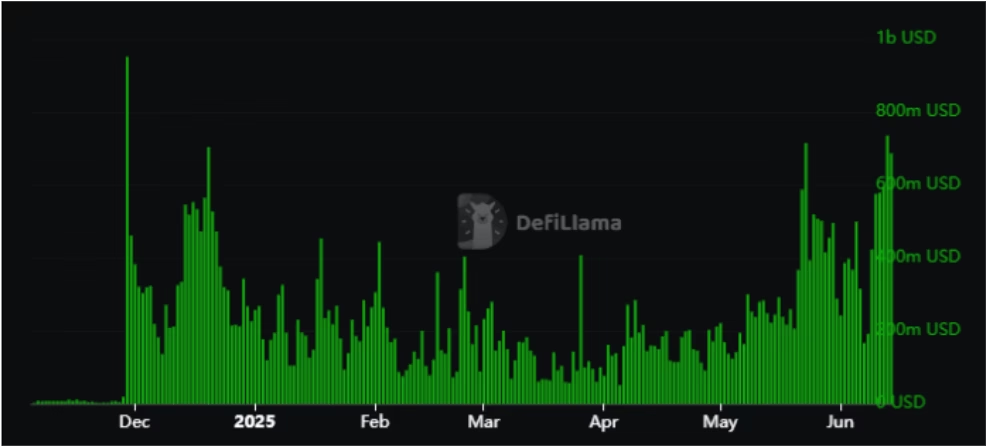

Additionally, Hyperliquid’s decentralized exchange (DEX) volumes have skyrocketed from a low of $50.9 million in early April to over $735 million on Friday. This aggressive growth reflects sustained adoption and increasing trust in the ecosystem.

HYPE’s role within the network—spanning payments, governance, liquidity provision, and staking—has helped it tap into this ecosystem-wide value, explaining its recent bullish run.

Outlook: Bullish Foundation vs. Bearish Short-Term Risks

While HYPE’s long-term outlook remains promising thanks to robust network growth and strong utility, short-term risks are mounting. If TVL and DEX volumes hold or climb further, bulls may regain confidence. However, a sharp decline in those metrics could cement a bearish reversal.

DISCLAIMER:

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.