- Cardano has sustained a four-day uptrend despite a broader market correction, fueled by record-high Open Interest of $1.77 billion.

- Technical indicators suggest ADA could soon reclaim the $1 mark if bullish momentum continues.

Cardano (ADA) continues to defy broader market weakness, extending its uptrend for the fourth straight day and breaking key resistance levels. The altcoin’s resilience, coupled with record-high derivatives activity, suggests that bulls are setting their sights on the $1 mark.

RELATED:Cardano (ADA) Breaks Key Trendline with 20% Surge – $1.54 Target Now Within Reach

Bullish Bets Drive ADA’s Open Interest to Record Levels

ADA’s strong performance comes amid a challenging market environment triggered by higher-than-expected US July Producer Price Index (PPI) data, which hinted at rising inflation. Despite this, traders are showing heightened interest in Cardano derivatives.

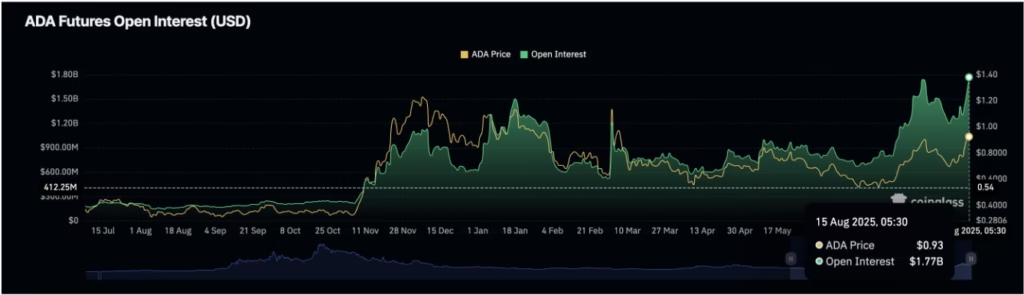

According to Coinglass data, ADA’s Open Interest — the total USD value of all active futures and options contracts — hit an all-time high of $1.77 billion on Friday, climbing from $1.57 billion just a day earlier. This $200 million jump signals fresh capital inflows and growing market participation.

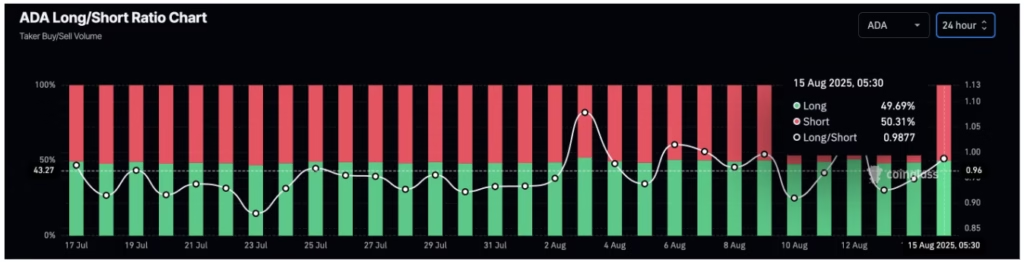

Bullish sentiment is also reflected in Cardano’s long/short ratio. Over the past three days, the proportion of long positions has risen from 48.07% to 49.69%, indicating a clear tilt toward optimistic price expectations.

Cardano Technical Breakout Targets $1

On Thursday, ADA closed at $0.9258, rebounding from a high of $1.0193 after overcoming a long-standing resistance trendline connecting the December 3 and March 3 highs. The price also moved above the critical 50% Fibonacci retracement level at $0.9187, drawn from December’s $1.3264 peak to April’s $0.5110 low.

If ADA maintains a daily close above $0.9187, analysts believe the rally could stretch toward the 61.8% Fibonacci level at $1.0149. Technical indicators back this outlook, with the MACD showing consistent growth in green histogram bars and the Relative Strength Index (RSI) holding at 69 — just shy of overbought territory, signaling strong buying pressure.

Key Levels to Watch

For bulls, the immediate target remains reclaiming and holding the $1 psychological barrier. A sustained break above $1.0149 could open the door to further gains.

On the downside, a pullback below $0.9187 might test the broken trendline support near $0.8898. A daily close below this trendline would invalidate the breakout and potentially lead to deeper losses.

With bullish positioning at record highs and technicals leaning positive, Cardano appears well-placed to challenge the $1 mark — provided market conditions remain favorable.

ALSO READ:Cardano Whales Accumulate Over 200 Million ADA in Two Days

DISCLAIMER:

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.