- Cardano has a staggering 74% share of failed cryptocurrency projects, highlighting its dominance in the realm of deadcoins.

- Additionally, it discusses broader trends in crypto failures, noting a significant drop in project failures in 2023.

A recent report has shed light on the alarming rate at which crypto projects failed, with Cardano emerging as a surprising leader in this unfortunate trend.

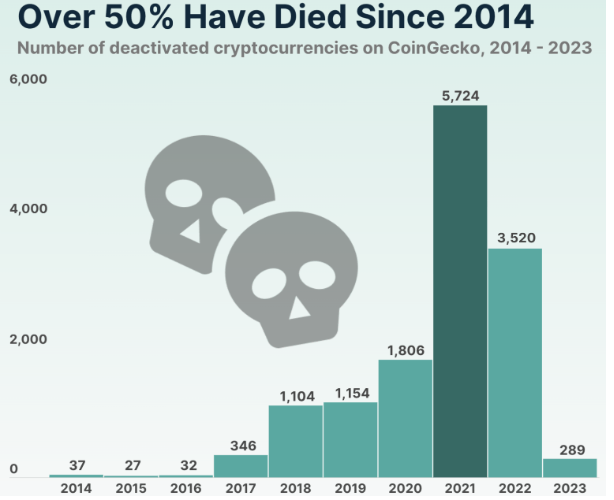

Since the advent of cryptocurrencies, thousands of projects have entered the market with ambitious goals and promises of revolutionizing various industries. However, the reality is starkly different, with over 14,000 cryptocurrencies having failed since 2014, according to the report.

Bull Runs: A Double-Edged Sword

The report underscores the correlation between bull runs and the subsequent failure of numerous crypto projects. The euphoria surrounding bull markets often leads to a surge in new project launches, but it also exposes the vulnerabilities of these ventures. During the 2020-2021 bull run alone, a staggering 7,530 cryptocurrencies were launched, only to meet their failed later on.

According to Crypto Twitter. @Cardano is a deadcoin…

— Market Mobster (@MarketMobsterUK) November 23, 2022

Good numbers from #DOT again.

Focus on projects building in the bear market. https://t.co/P58gB1kPli

Cardano and Terra: Leaders in Project Failures

Surprisingly, Cardano and Terra have emerged as the frontrunners in terms of project failures. Despite their initial hype and promising technology, both ecosystems have witnessed a high rate of project failures, contributing significantly to the growing number of “deadcoins” in the market.

While the statistics paint a grim picture of the cryptocurrency landscape, there are glimmers of hope on the horizon. The report highlights a significant drop in project failures in 2023, suggesting that the industry may be maturing and becoming more discerning in its approach to new ventures.

Quality Over Quantity

One of the key takeaways from the report is the importance of quality over quantity in the cryptocurrency space. The era of simply launching a token and expecting overnight success is coming to an end. Investors and project teams alike are realizing the importance of due diligence, regulatory compliance, and sustainable business models.

As the cryptocurrency market continues to evolve, it is imperative for stakeholders to learn from past failures and adapt accordingly. While the road ahead may be fraught with challenges, it is also filled with opportunities for those willing to navigate it wisely.

While cardano may currently hold the dubious honor of having the highest percentage of failed projects, the broader trend suggests that the cryptocurrency industry as a whole is undergoing a period of introspection and refinement. As the dust settles, only time will tell which projects will emerge victorious in this ever-changing landscape.