- Cardano trades at $0.86 after a 6% drop but shows strong whale accumulation and network activity supporting bullish signals.

- Analysts project a potential breakout above $1, with long-term targets reaching as high as $2.05 by 2025.

Cardano (ADA) faced a sharp correction this week, yet on-chain signals and whale activity suggest a bullish rally could soon emerge. The cryptocurrency trades at $0.86 after a 6.67% decline but continues to show resilience as institutional investors strengthen their positions.

Cardano Holds Firm After 6% Decline

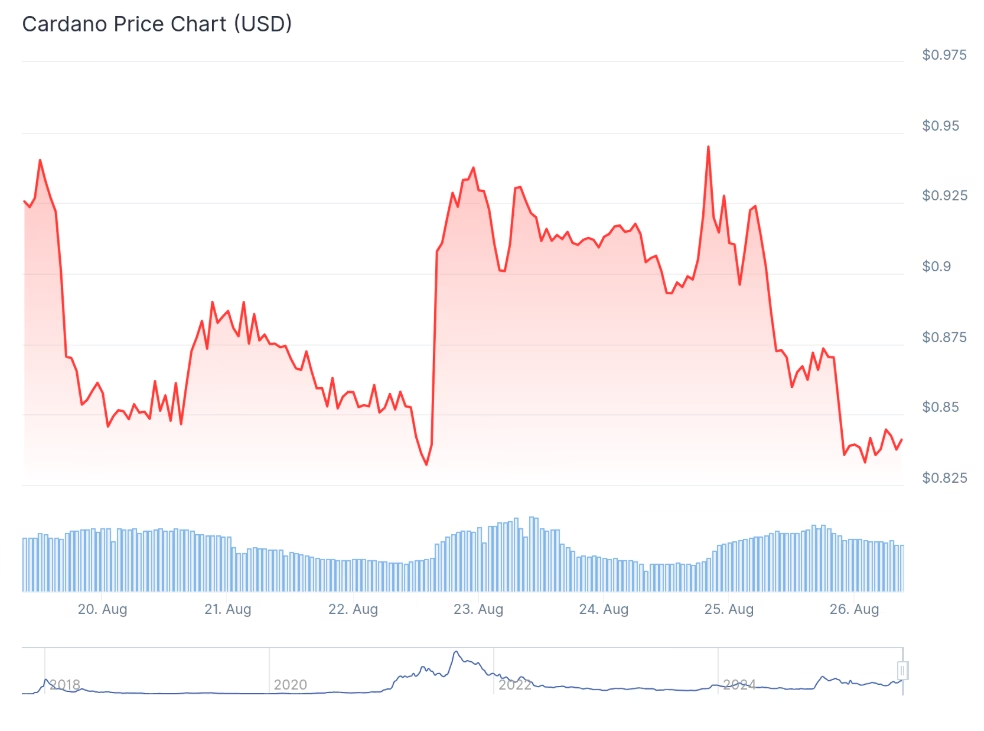

Cardano slipped from $0.93 to $0.86 as Bitcoin’s pullback dragged the wider market lower. Despite this correction, ADA has maintained a bullish structure on its daily chart, supported by strong trading activity throughout August. The token rallied 13% earlier this month from the $0.70 support level, showing renewed market strength.

The $1 resistance remains a crucial barrier. ADA briefly tested this level on August 14 but failed to break through. Technical indicators now suggest another attempt is imminent, with projections pointing to $1.20 if the psychological threshold is cleared.

Cardano Whale Accumulation Signals Confidence

While retail investors reduced exposure, large holders showed confidence by adding 130 million ADA tokens in recent days. Wallets holding between 10–100 million ADA expanded positions, highlighting a divergence between institutional and retail strategies.

The mean coin age has also trended upward, signaling a shift from distribution to accumulation. This metric reflects investor conviction as more tokens remain dormant, reducing short-term selling pressure.

Strong Network Activity and Development

Cardano continues to see robust ecosystem usage, with over 2.6 million daily transactions recorded in August. In the first half of 2025 alone, the network processed nearly 450 million transactions, proving its sustained adoption.

Development activity remains another strength, with Cardano’s 80.86 score significantly outpacing Ethereum’s 25.05. Steady daily active addresses further confirm ongoing participation across the blockchain.

Technical Outlook and Price Forecast

Key technical indicators support a bullish scenario. MVRV Z-scores above 0.4, rising funding rates, and futures open interest of $1.44 billion suggest strong institutional demand. Analysts now eye $1.01–$1.15 as near-term targets, while a confirmed breakout could push ADA to $1.20.

Looking further ahead, projections vary. Some analysts foresee ADA potentially reaching $2.05 by the end of 2025 under favorable conditions such as ETF approval and growing retail adoption. Others remain more conservative, expecting an average price near $0.945.

Despite its recent 6% drop, Cardano shows signs of resilience. Whale accumulation, strong development activity, and robust network usage all point to renewed bullish energy. If ADA can break the $1 resistance, the path toward higher targets, including $1.20 and beyond, looks increasingly attainable.

DISCLAIMER:

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.