- Cardano (ADA) has outperformed Bitcoin, Ethereum, and Solana in institutional inflows, with $63.3 million recorded in March 2025, amid a broader market decline.

- This surge was sparked by President Trump’s announcement of a U.S. Strategic Crypto Reserve, which included ADA, boosting investor interest and adoption.

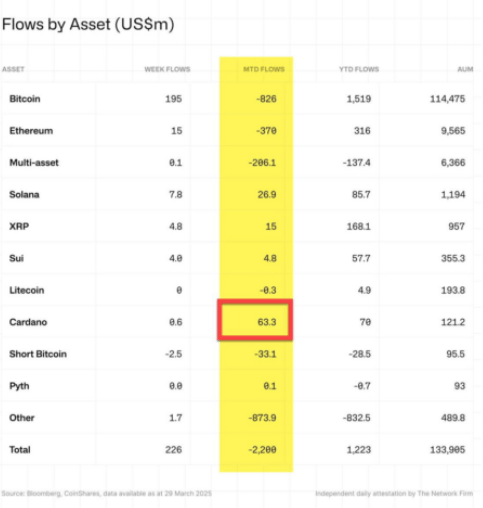

In a surprising turn of events, Cardano (ADA) has outpaced leading cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) in institutional inflows over the past month. With $63.3 million in month-to-date (MTD) investments as of March 29, 2025, Cardano has emerged as the top-performing digital asset, making waves in the institutional crypto landscape.

Cardano’s Remarkable Growth Amidst Market Decline

While the broader cryptocurrency market has been grappling with significant outflows—totaling a staggering $2.2 billion this month—Cardano has managed to buck the trend. Bitcoin, despite pulling in $195 million in weekly inflows, suffered from $826 million in outflows, leaving its overall performance in the red. Similarly, Ethereum faced a tough month, losing $370 million in MTD outflows.

In contrast, Cardano’s surge in institutional interest has been impressive. Its strong performance comes even as the broader market shows signs of decline, and other altcoins, like Solana, have experienced relatively smaller inflows, with Solana recording just $26.9 million.

The Trump Factor: How ADA Gained Traction

One of the key catalysts behind Cardano’s rise in institutional inflows was an announcement by President Trump on March 2, 2025, regarding the creation of a U.S. Strategic Crypto Reserve. Cardano, along with XRP and Solana, was included in the reserve, which caused ADA’s price to skyrocket by 50% within just 90 minutes of the news. While the government later revised its stance—deciding to separate the reserve into a Bitcoin-only fund and an altcoin stockpile—the initial hype surrounding ADA’s inclusion continues to fuel its momentum.

The buzz from the U.S. Strategic Crypto Reserve announcement has sparked increased adoption, with more investors eyeing Cardano as a promising asset. As a result, ADA’s futures open interest surged to $702 million, marking a 10% increase year-to-date according to a Coinglass report.

ADA’s Volatility and Market Behavior

Despite its recent success, ADA continues to show signs of volatility. Over the past 24 hours, the token has been consolidating between $0.67 and $0.62, currently trading at $0.6550. Today, ADA has gained 4%, bringing its price to $0.65. However, the trading volume is facing challenges, recording a 20% drop in the last 24 hours to $923 million.

Cardano’s rise in institutional inflows signals growing investor confidence, but like any asset, its price is subject to market fluctuations. Whether it can maintain this momentum remains to be seen, but for now, ADA stands as a key player in the cryptocurrency world.