- Cardano is seeing increased accumulation by large investors while retail holders continue to sell, signaling diverging confidence levels.

- Rising open interest and bullish technical indicators suggest a potential breakout, though a drop to $0.50 remains possible if bearish pressure returns.

Cardano (ADA) is navigating a critical zone, slipping slightly under 1% after a brief rally, but signs of strength from large investors suggest a possible trend reversal is underway. While retail investors are stepping back, whales are seizing the opportunity to accumulate ADA at discounted levels, potentially setting the stage for a significant upward move.

Cardano Whales Buy the Dip, Retail Investors Lose Confidence

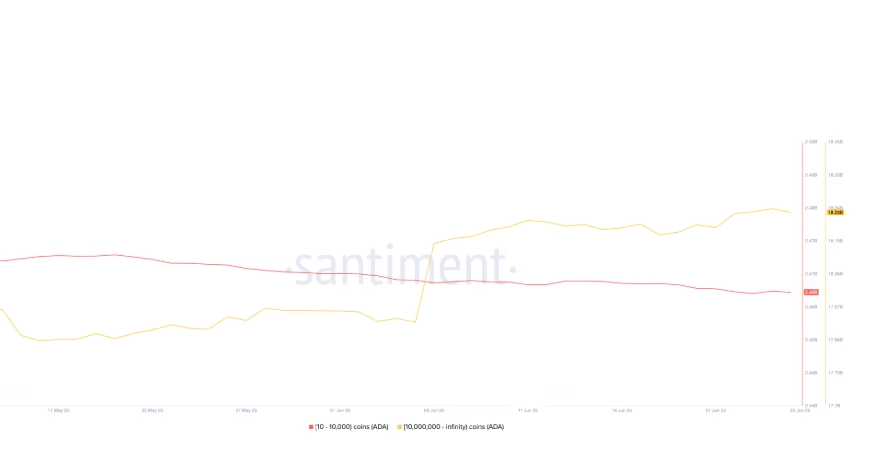

On-chain data paints a contrasting picture between investor classes. According to Santiment, retail traders holding 10 to 10,000 ADA have offloaded 10 million tokens since June 1, reducing their total holdings to 2.46 billion ADA. In contrast, whales—investors with more than 10 million ADA—have added a staggering 270 million ADA to their bags in June alone, increasing their total holdings to 18.23 billion ADA.

This divergence signals a waning risk appetite among smaller holders while long-term investors double down on their positions, reflecting growing institutional confidence in ADA’s future.

Derivatives Data Hints at Bullish Bias

Data from CoinGlass reveals that ADA’s open interest has climbed to $717.28 million, up 1.48% in 24 hours. This uptick suggests rising capital inflows and increased participation in the derivatives market. The positive funding rate of 0.0042% further reinforces this bullish sentiment, indicating that long positions are slightly outpacing short bets.

The long/short ratio of 1.0367 remains neutral but leans bullish, with long liquidations at $296K versus short liquidations at $303K, underscoring the market’s balanced but upward-leaning structure.

Price Targets and Technical Signals

Cardano’s price action reflects a potential recovery within a falling channel, with the upper boundary near $0.64 as the immediate target. A close above this trendline could pave the way for a move toward the next resistance at $0.7309.

Technical indicators are gradually aligning with a bullish bias. The MACD is nearing a bullish crossover, and the histogram’s weakening red bars indicate fading selling pressure. The RSI has also bounced from oversold levels to 38, suggesting a possible recovery is building.

However, if ADA closes bearish midweek, a fallback to the key $0.50 support remains on the table.

ALSO READ:XRP’s Breakout Window Is July to September — Analysts Predict Massive Upside

DISCLAIMER:

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.