- Cardano (ADA) faces mixed signals as whales accumulate over 20 million tokens while retail traders take profits, pushing price down to $0.85-$0.90.

- Key support lies at $0.82, with potential upside targets at $1.15 and $1.25 if ADA breaks above $0.95.

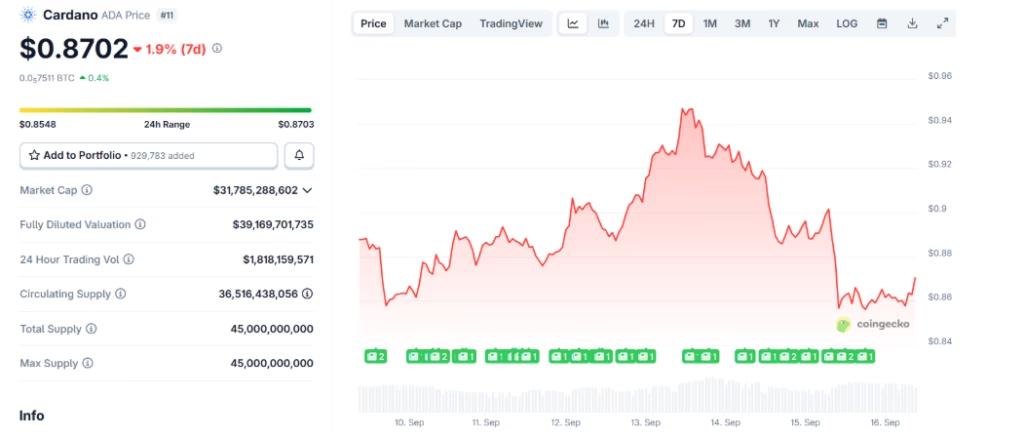

Cardano (ADA) is trading between $0.85 and $0.90 after a sharp 7% correction over the last two days. The drop came as retail holders booked profits, creating short-term selling pressure.

Despite this, on-chain data reveals that whales accumulated more than 20 million ADA in just 24 hours on September 13, signaling confidence from large investors.

Whales are back! They bought over 20 million Cardano $ADA in the last 24 hours. pic.twitter.com/uwdkOer10c

— Ali (@ali_charts) September 12, 2025

Whale Accumulation Strengthens Support

The buying spree took place near the $0.86 to $0.90 support zone, reinforcing a technical base that has been tested several times. Historically, whale activity aligns with market turning points, and their accumulation often provides much-needed liquidity. Cardano’s market cap still hovers around $33 billion, showing that demand remains steady even during corrections.

Retail Profit-Taking Creates Pressure

While whales are buying, retail traders are moving in the opposite direction. Data from Santiment shows the Network Realized Profit/Loss metric hit its highest level since late July, confirming that many holders are selling into strength. Coinglass data further reflects this trend, with the long-to-short ratio dropping to 0.87—the lowest in over a month. This indicates growing bearish sentiment among short-term traders.

Cardano Key Technical Levels to Watch

Cardano now faces critical support at $0.82, which aligns with the 61.8% Fibonacci retracement level. A drop below this threshold could push ADA toward $0.76. On the upside, resistance sits between $0.95 and $0.97. A decisive breakout above this range could open the door to higher targets at $1.15 and $1.25.

The Relative Strength Index (RSI) currently sits at 49, slightly below neutral, while the Moving Average Convergence Divergence (MACD) lines are edging closer to a bearish crossover. However, recent trading volume suggests dips are being bought, highlighting ongoing interest in ADA at lower levels.

Outlook for Cardano ADA

Cardano’s price action shows a tug-of-war between whale accumulation and retail profit-taking. If ADA holds above $0.84, it could stage a recovery toward $1.02, the August 14 high. However, failure to defend the $0.82 support could trigger further downside. For now, the market remains uncertain, with both bullish and bearish forces shaping ADA’s next move.

DISCLAIMER:

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.