Chainlink Cryptonewsfocus.com

- Chainlink has reached a record 769,380 holders, showing strong network growth and rising investor interest.

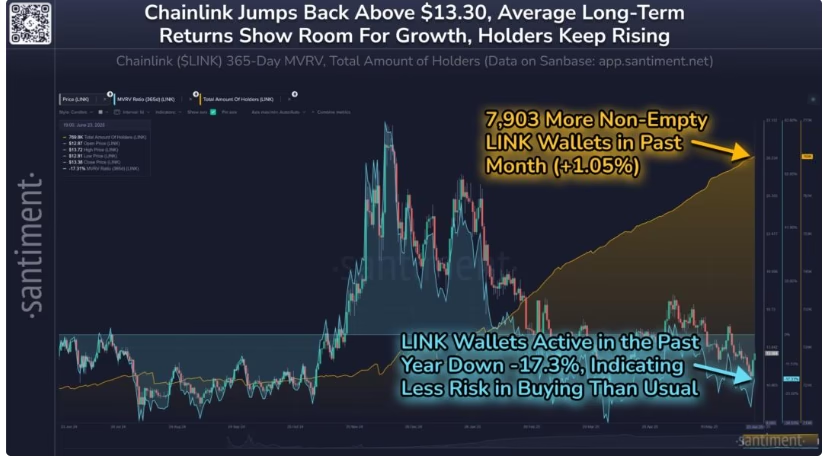

- Its 1-year MVRV ratio at -17.3% signals a possible long-term buying opportunity.

Chainlink (LINK) is seeing a notable rise in adoption, with its total number of holders reaching a new all-time high. On-chain data from Santiment reveals a steady influx of new addresses on the Chainlink network, suggesting growing investor interest and potential for long-term gains.

Surge in Chainlink Holders Marks Growing Adoption

According to Santiment, the Total Amount of Holders metric — which tracks the number of non-zero balance addresses — has risen sharply over recent months. In the past 30 days alone, over 7,900 new holders have joined the Chainlink ecosystem. This pushes the total holder count to a record 769,380, a clear sign of expanding interest in LINK, whether from new investors or existing users diversifying their wallets.

This uptick in holder numbers often signals increasing adoption, especially when accompanied by broader engagement across the ecosystem. While the creation of new wallets may sometimes be for privacy or strategic redistribution, the overall trend points to Chainlink becoming more widely held and trusted within the crypto space.

Chainlink’s 1-Year MVRV Ratio Signals a Buying Opportunity

Santiment’s analysis also highlights Chainlink’s 365-day MVRV Ratio, which currently sits at -17.3%. This means that LINK holders who bought within the past year are, on average, sitting on a 17.3% loss.

Interestingly, this isn’t necessarily a bearish signal. Historically, negative MVRV ratios can point to a buying opportunity, as traders in loss are less likely to sell. This reduces short-term sell pressure and may set the stage for upward price movement — especially when combined with rising adoption.

Santiment suggests that the current MVRV reading puts LINK in what it calls an “opportunity zone” for long-term investors. Essentially, this phase offers potential value for those willing to hold through volatility.

LINK Price Holds Steady Amid Positive Metrics

At the time of writing, Chainlink is trading at around $13.15, up over 2% in the past week. While the price has remained relatively stable, the increase in holders and historically favorable MVRV data could position LINK for a more bullish phase ahead.

As on-chain fundamentals continue to strengthen, investors may view this as a strategic time to enter or accumulate — with metrics aligning to suggest that Chainlink’s long-term outlook remains promising.

ALSO READ:Chainlink Partners with Mastercard to Bring DeFi to Over 3 Billion Users