- Chainlink (LINK) is under selling pressure after whale wallet 0x7fBB deposited $5.8 million worth of tokens into Binance, triggering a 10% price drop over the past week.

- Technical indicators like MACD, BBP, and Elliott Wave analysis all point to a continued bearish trend unless LINK breaks above the $14.74 resistance level.

Chainlink (LINK) is facing increased selling pressure after a whale deposited over $5.8 million worth of tokens into Binance, sparking fears of a possible price dip. Whale wallet 0x7fBB transferred 403,000 LINK tokens to the exchange, aligning with growing technical signals that hint at a bearish trend for the popular altcoin.

Chainlink Whale Action Signals Bearish Pressure

The whale’s move isn’t without precedent. Between March 2023 and March 2024, this same investor acquired 1.75 million LINK from Kraken at an average price of $7.03 per token. With prices nearly doubling since then, the recent deposit could be part of a broader strategy to cash out for profit.

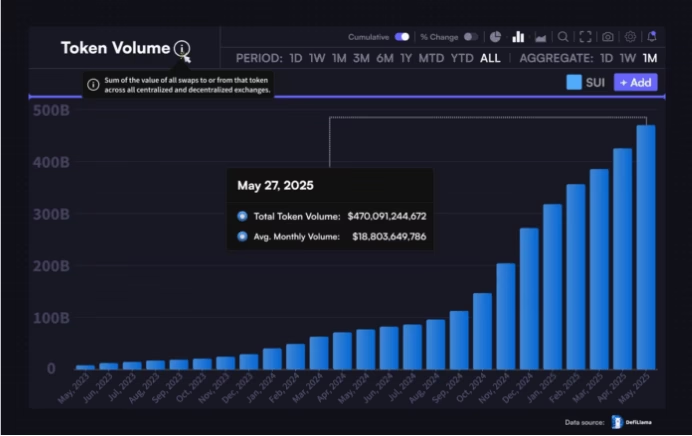

As large holders begin to sell, market reactions can be swift. Since the transfer began on May 27, LINK trading volume surged 20%, surpassing $290 million by June 5. However, this has not worked in LINK’s favor. The token dropped over 10% in the last week alone, with prices falling to around $13—down 4% in the past 24 hours.

Technical Indicators Point to Further Decline

The broader technical outlook reinforces the bearish tone. Chainlink is struggling to break through the $14.74 resistance level. According to Elliott Wave analysis, LINK appears to be in a corrective wave phase—specifically wave-(5) C of ii. Until the token decisively breaks past $14.74, the bearish trend is expected to persist.

Supporting this, the MACD indicator shows that the MACD line remains below the signal line. In addition, the histogram has turned red, indicating that bearish pressure is growing.

The Bull Bear Power (BBP) indicator also paints a pessimistic picture. With a value of -0.2737, the BBP suggests that sellers remain in control, consistently outpacing buyer interest.

Support and Resistance Levels to Watch

Traders are eyeing key price levels for signs of reversal or further decline. Immediate support sits at $13.50, while resistance stands at $15.20. LINK touched an intraday high of $14 before retreating under heavy selling.

Until bullish signs emerge and whale selling slows, Chainlink could remain under pressure. The coming sessions will be crucial in determining whether LINK can hold above support—or continue sliding.

ALSO READ:Why Ethereum Price Is Falling Despite Strong Institutional Interest

DISCLAIMER:

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.