Chainlink Cryptonewsfocus.com

- Chainlink (LINK) surged 22% this week, holding strong above the key $17.50 support level with potential to reach $21 soon.

- Long-term price forecasts for 2025 vary widely, ranging from conservative estimates near $16 to bullish predictions above $43.

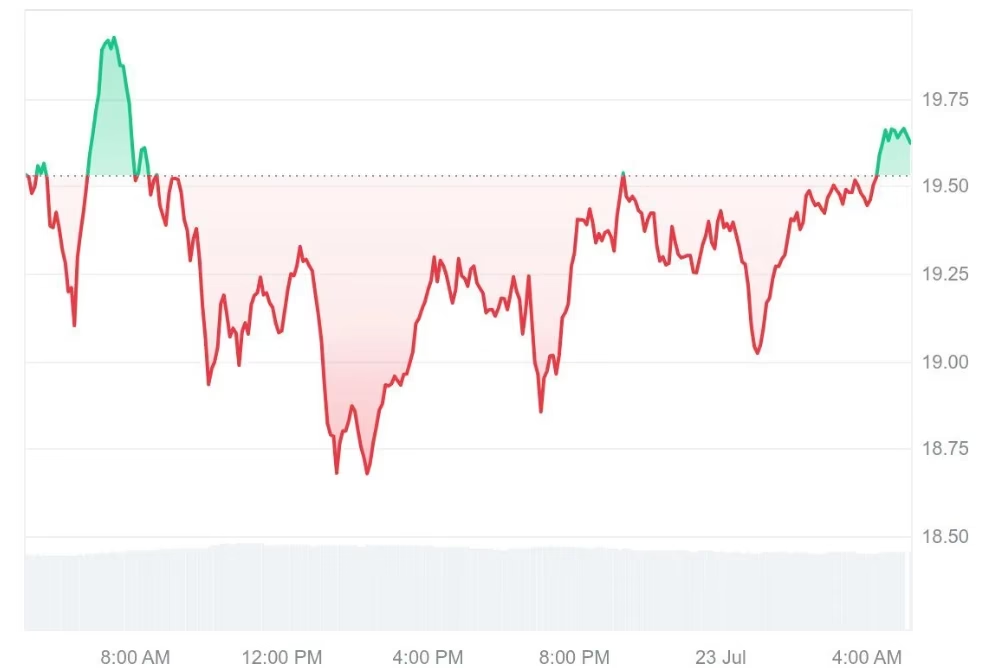

Chainlink (LINK), the decentralized oracle network token, has made impressive gains recently, sparking fresh optimism among investors and analysts alike. Trading at around $19.62, LINK surged 22.61% over the past week, signaling strong buying interest and potential for further upside.

Strength Above Key Support Boosts Confidence

A critical factor behind Chainlink’s recent rally is its ability to hold above the important $17.50 support level. Technical analysts see this as a solid foundation for further gains. Despite broader market fluctuations affecting many cryptocurrencies, LINK has maintained its weekly highs, suggesting growing accumulation and increased investor confidence in its long-term prospects.

Trading volume also climbed slightly to $1.08 billion, reinforcing the view that demand is building. This level of volume, combined with price strength, often points to healthy market activity and could support a continued bullish trend.

Chainlink Short-Term Outlook: Is $21 Within Reach?

Prominent crypto analyst Crypto_Jobs expressed a bullish short-term view, revealing they have increased exposure to LINK using 5x leverage, betting on the token’s resilience above $17.50. The analyst predicts that, if LINK sustains this level, it could soon test the $21 mark and possibly move even higher.

Resistance at $20 remains a hurdle, representing a 50% Fibonacci retracement level—a common technical resistance point. However, subdued selling pressure near this level hints that bears are cautious, increasing the likelihood of a breakout if buying volume stays strong.

Mixed Long-Term Price Forecasts for 2025

Looking ahead to 2025, Chainlink’s price prospects are varied. DigitalCoinPrice projects a bullish scenario where LINK climbs past previous lows early in the year and potentially soars above $43.22, even challenging its all-time high near $52.88. This optimism is grounded in Chainlink’s expanding adoption and ongoing development.

On the other hand, Changelly offers a more conservative forecast, expecting LINK to trade between $13.69 and $16.76, with an average around $19.82 for 2025. Their model anticipates modest gains, reflecting cautious sentiment in the market.

Chainlink’s recent 22% surge reflects renewed investor interest and technical strength. While short-term momentum points to a potential move above $21, longer-term forecasts remain mixed, reflecting broader market uncertainties. For traders and holders, keeping an eye on the $17.50 support level and trading volume will be key to navigating LINK’s next moves.

DISCLAIMER:

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.