Chainlink Cryptonewsfocus.com

- Chainlink recorded a 105% surge in large transactions within 24 hours, signaling growing whale activity despite a $202 million market-wide liquidation.

- Recent developments, including a Mastercard partnership and its role in powering Kraken’s tokenized stocks, may be fueling institutional interest in LINK.

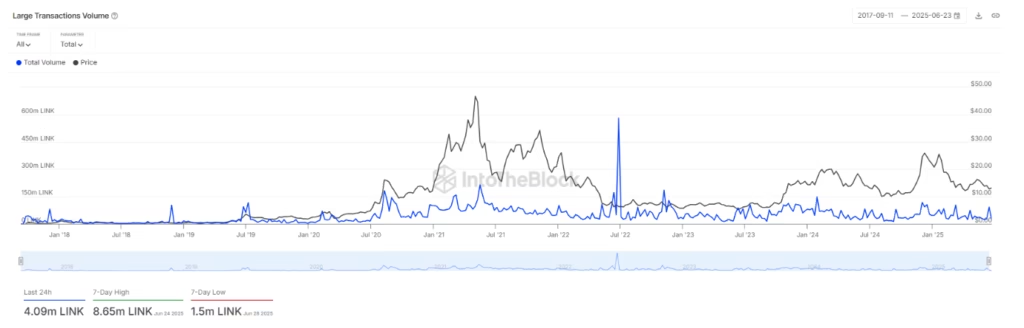

Chainlink (LINK) has defied broader market turbulence with a remarkable 105% spike in large transactions over the last 24 hours. On-chain data from IntoTheBlock reveals that transfers above $100,000 — typically made by institutional investors or crypto whales — soared to 4.09 million LINK, valued at around $54.8 million. This activity comes as the wider crypto market suffers a sharp correction, with $202 million in liquidations recorded across various digital assets.

While major coins like Bitcoin and Ethereum dipped, and LINK itself dropped slightly by 0.89% to $13.10, the sudden surge in whale interest suggests confidence in Chainlink’s long-term value. This uptick in transactions could indicate strategic positioning from large holders looking to accumulate during market pullbacks.

Institutional Confidence Grows Amid Red Market

The spike in whale activity comes at a time when most cryptocurrencies are in the red, kicked off by profit-taking and increasing macroeconomic uncertainty. Yet, a few assets — including XRP, Algorand, and Bitcoin Cash — have shown resilience.

Chainlink’s recent ecosystem developments may explain the rising whale confidence. Just last week, Chainlink partnered with Mastercard to facilitate direct on-chain cryptocurrency purchases for over three billion cardholders. This strategic alliance enhances LINK’s real-world utility and visibility among mainstream financial players.

Chainlink Expands Real-World Integration

Another major milestone for Chainlink is its launch of the Automated Compliance Engine (ACE). This modular standard aims to streamline on-chain regulatory compliance, potentially unlocking more institutional capital for decentralized finance (DeFi).

Furthermore, Chainlink has become the official oracle provider for Kraken’s xStocks — a new platform offering tokenized U.S. equities to non-U.S. users. LINK will now power pricing data for globally accessible tokenized stocks and ETFs, further embedding itself at the heart of traditional and decentralized financial systems.

Despite a bearish market kickoff to July, Chainlink is showing signs of strong institutional interest and strategic growth. With major partnerships and technological rollouts underway, LINK’s fundamentals remain solid. Whale activity doubling during a market downturn sends a clear message: smart money may be betting big on Chainlink’s future.

ALSO READ:Chainlink Hits Record 769K Holders as MVRV Ratio Signals Opportunity