- Coinbase has expanded its offerings by launching futures contracts for natural gas and Cardano (ADA), bridging the gap between traditional commodities and cryptocurrency trading.

- This move provides investors with new opportunities for portfolio diversification, risk management, and market speculation on a broader financial platform.

Coinbase, one of the world’s leading cryptocurrency exchanges, has made a bold move by launching futures contracts for natural gas and Cardano (ADA). This development marks a significant expansion in Coinbase’s trading portfolio, providing investors with more diversified opportunities in both the crypto and energy markets.

Bridging the Gap Between Crypto and Commodities

The introduction of natural gas futures on Coinbase is a step towards integrating traditional commodities into the digital trading space. As global energy markets fluctuate due to geopolitical tensions and economic shifts, the availability of natural gas futures on a crypto-centric platform could attract both institutional and retail investors looking to hedge risks or speculate on price movements.

By offering natural gas futures, Coinbase enters a domain typically dominated by traditional exchanges such as the Chicago Mercantile Exchange (CME) and the Intercontinental Exchange (ICE). This strategic move highlights Coinbase’s ambition to become a broader financial trading hub rather than solely a cryptocurrency exchange.

Cardano Futures: A New Avenue for Crypto Traders

Alongside natural gas, Coinbase is also introducing futures contracts for Cardano (ADA), one of the most popular blockchain platforms known for its focus on scalability, security, and sustainability. Cardano has gained significant traction in recent years, with a strong community backing and ongoing technological advancements, such as smart contract capabilities.

The addition of Cardano futures allows traders to take long or short positions on ADA’s price movements, providing more flexibility in portfolio management. This also opens the door for institutional investors who prefer derivatives trading over direct crypto purchases.

Why This Matters for Investors

Coinbase’s move signals an increasing convergence between traditional and digital financial markets. By integrating a commodity like natural gas with a cryptocurrency like Cardano, the platform caters to a broader audience, from energy traders to crypto enthusiasts.

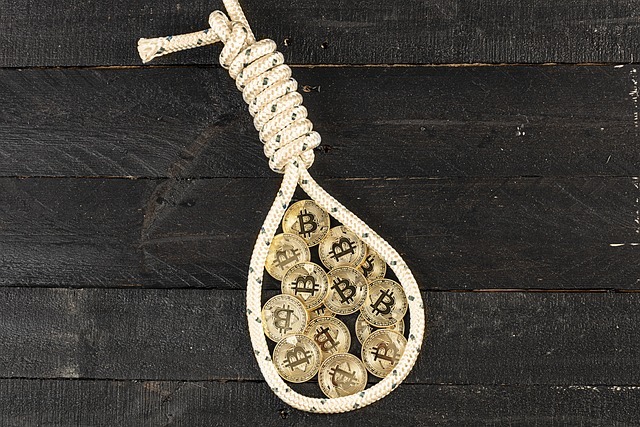

For traders, futures contracts offer benefits such as leverage, risk management, and the ability to profit from both rising and falling markets. However, they also come with higher risk due to market volatility and leverage-related losses.

The Future of Futures on Coinbase

As Coinbase continues to expand its offerings, the addition of futures contracts could attract more sophisticated traders and institutional investors. Whether this will pave the way for further integration of traditional assets into crypto exchanges remains to be seen, but one thing is clear—Coinbase is making strides toward becoming a more comprehensive financial ecosystem.

With this latest development, traders now have more tools at their disposal to navigate the ever-evolving financial landscape, whether in the world of cryptocurrencies or traditional commodities.