- Coinbase will launch 24/7 Bitcoin and Ethereum futures trading for US users on May 9, along with new perpetual-style contracts that allow traders to hold positions indefinitely.

- This move aims to boost flexibility, reduce reliance on offshore exchanges, and attract greater institutional participation in the US crypto derivatives market.

In a move that could redefine how US investors interact with digital assets, Coinbase Derivatives has announced the launch of 24/7 Bitcoin and Ethereum futures trading starting May 9, 2025. This marks a major milestone for American crypto traders who have long been constrained by limited market hours and rigid contract expiration dates.

The new trading feature is designed to eliminate timing inefficiencies, enabling traders to respond to market shifts in real time—day or night. Backed by Coinbase Financial Markets and cleared through Nodal Clear, this initiative also introduces a robust institutional framework to support increased trading volume and compliance.

A New Era of Flexibility with Perpetual-Style Futures

Coinbase is not stopping at extended trading hours. The platform is also set to roll out perpetual-style futures contracts, a product that allows investors to maintain positions indefinitely. Unlike traditional futures, these contracts have no expiration dates, allowing traders to hold long-term strategies without disruptions.

This approach is expected to offer greater flexibility for hedging and strategic positioning, while also reducing the need for US traders to rely on offshore exchanges—many of which have traditionally offered more dynamic trading options.

Bridging the Gap in US Crypto Markets

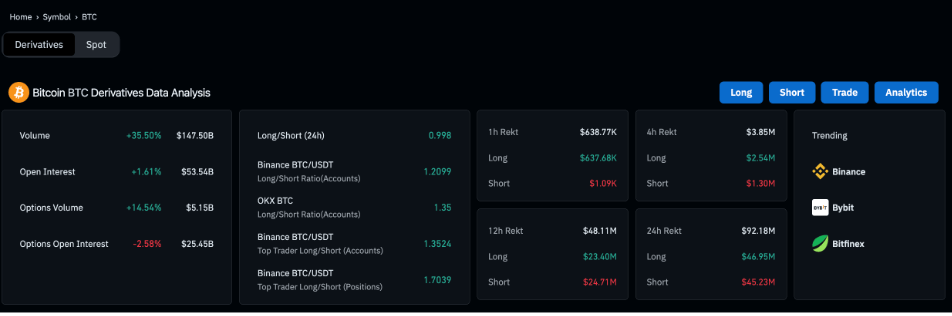

Currently, derivatives make up more than 75% of global crypto trading volume, according to CCdata. However, US-based platforms have lagged behind due to regulatory hurdles and limited product offerings. Coinbase’s latest move could shift this dynamic, especially as the platform continues to work closely with the Commodity Futures Trading Commission (CFTC) to expand its range of compliant derivatives products.

The timing is no coincidence. Just one day before the Coinbase announcement, the US Congress advanced a key bill aimed at regulating crypto stablecoins. This development aligns with the Trump administration’s broader push for tighter crypto oversight to help manage national debt and improve financial transparency.

Institutional Interest on the Rise

Bitcoin futures open interest currently stands at $53 billion, reflecting growing appetite for crypto derivatives. With Coinbase stepping up to offer regulated, 24/7 trading and perpetual contracts, analysts anticipate a surge in institutional engagement in the US crypto space.

As May 9 approaches, traders and investors alike will be watching closely. Coinbase’s move could be the spark that brings a new wave of capital and credibility to the US crypto derivatives market.