- Binance founder Changpeng Zhao faces sentencing in a federal court in Seattle, with prosecutors seeking a three-year jail term after pleading guilty to money laundering and sanctions violations.

- The prosecution emphasizes the gravity of Zhao’s intentional actions, while his defense highlights his acceptance of responsibility and portrays him as a philanthropic family man, leaving his fate uncertain amidst a legal showdown.

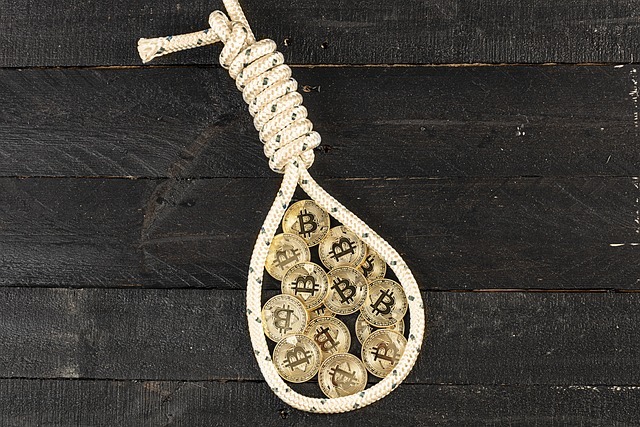

Binance, the world’s largest cryptocurrency exchange, faces yet another tumultuous turn as its founder and former CEO, Changpeng Zhao, awaits sentencing in a federal court in Seattle. Zhao, along with his company, pleaded guilty last year to violating federal money laundering laws and sanctions, casting a shadow over the once-thriving crypto empire.

In the plea deal struck, Zhao agreed to step down as Binance’s CEO and cough up a hefty $50 million fine for failing to maintain an effective anti-money laundering program. This comes in the wake of sanctions violations linked to users in Iran, Cuba, Syria, and Russian-occupied areas of Ukraine—a stark reminder of the regulatory tightrope the crypto industry walks.

The prosecution, however, isn’t pulling punches. Justice Department lawyers have recommended a three-year prison sentence for Zhao, emphasizing the need to hold him accountable for his actions. They argue that such a sentence is necessary not only to address Zhao’s intentional criminal conduct but also to send a strong message to the global crypto community about the repercussions of flouting regulations.

Federal guidelines suggest a milder 12 to 18-month sentence for such offenses, but prosecutors contend that this would fall short of reflecting the gravity of Zhao’s actions or deterring future violations. In contrast, Zhao’s defense team has proposed a mere five months’ probation, highlighting his acceptance of responsibility and the toll his legal battles have already taken on his personal life.

Amidst this legal maelstrom, Zhao’s supporters have rallied around him, portraying him as a philanthropist and family man. Letters from family, investors, and even UAE royals flood the court filings, painting a picture of a man deeply entrenched in both business and charity endeavors.

Yet, federal prosecutors remain steadfast in their stance, denouncing Zhao’s actions as deliberate and profit-driven. They argue that Zhao knowingly flouted U.S. laws to fuel Binance’s growth and fill his own coffers, casting a dark shadow over his once-flourishing crypto empire.

As the crypto world holds its breath, awaiting the court’s decision, Zhao’s fate remains uncertain—a stark reminder of the regulatory challenges that continue to loom large over the burgeoning cryptocurrency industry.