- The Czech National Bank (CNB) is considering allocating up to 5% of its €140 billion reserves to Bitcoin, marking a bold departure from traditional central bank investment strategies.

- Governor Aleš Michl sees Bitcoin as a potential tool for portfolio diversification, despite its volatility, and predicts that other central banks may follow suit in the next five years.

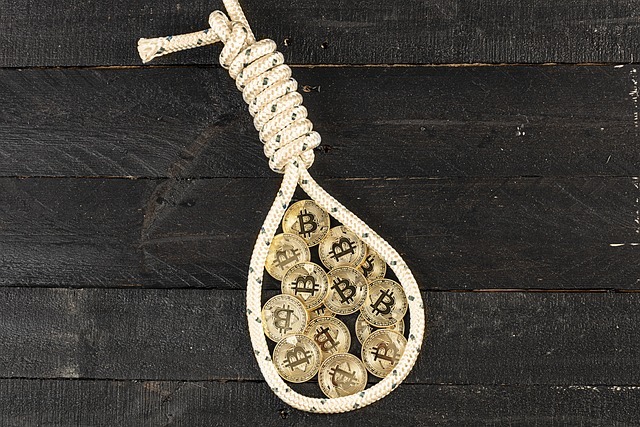

In a move that could shake the foundations of traditional banking, the Czech National Bank (CNB) is considering allocating a portion of its substantial reserves to Bitcoin. Governor Aleš Michl, known for his unorthodox financial views, is set to propose that the CNB invest up to 5% of its €140 billion ($145 billion) reserves into the volatile cryptocurrency. This could make the CNB the first Western central bank to take such a radical step.

A Departure from Tradition

Central banks are typically known for their conservative investment strategies, often relying on assets like U.S. Treasuries and high-rated bonds. The CNB, however, has a history of thinking outside the box. Currently, the bank holds a 22% equity allocation in its portfolio, and Michl plans to further increase its stake in U.S. equities. But Bitcoin? That’s an entirely different ball game.

Despite Bitcoin’s reputation for extreme volatility, Michl sees the cryptocurrency as a potential alternative investment. Drawing inspiration from the growing institutional interest in Bitcoin, including the launch of exchange-traded funds (ETFs) by financial giants like BlackRock, Michl believes that diversification into Bitcoin could yield substantial returns over time.

Why Bitcoin, and Why Now?

Michl acknowledges that Bitcoin is far from risk-free, noting its high volatility. However, he points to the rising interest from global investors, including the impact of former President Donald Trump’s stance on deregulation and his administration’s growing acceptance of cryptocurrencies. Michl also highlights Trump’s executive order to explore a national digital asset stockpile as a signal that central banks should start considering digital currencies as part of their future strategy.

The proposed Bitcoin allocation represents a divergence from the traditional caution displayed by central banks. While the European Central Bank (ECB) and Bundesbank have voiced strong skepticism toward Bitcoin, with some calling it a “digital tulip,” Michl argues that Bitcoin has the potential to play a role in portfolio diversification.

Risks and Rewards

Michl is realistic about Bitcoin’s risks, admitting that the cryptocurrency could potentially fall to zero. He also recognizes the possibility of it achieving “an absolutely fantastic value.” However, he believes that Bitcoin could significantly increase the portfolio’s returns, citing how holding 5% of reserves in Bitcoin over the past decade would have boosted annual returns by 3.5 percentage points.

Despite the risks, Michl’s bold stance could inspire other central banks to follow suit. He predicts that within the next five years, many institutions will adopt similar strategies, just as hedge funds and commercial banks have begun to explore the crypto space.

A Global Shift?

While the Czech Republic is far from embracing Bitcoin as a mainstream currency—its President has openly opposed the idea of joining the Eurozone—Michl’s proposal signifies a changing global perspective on digital assets. As central banks around the world weigh the potential of cryptocurrencies, the CNB’s move could be the first domino in a series of major shifts in global monetary policy.

The Czech Republic may be entering uncharted territory, but if Michl’s proposal succeeds, it could mark the beginning of a new era for central banks—and for Bitcoin.