- Dogecoin is showing signs of a double bottom reversal pattern, with key technical indicators and rising trader interest pointing to a potential breakout toward $0.25.

- However, it faces multiple resistance levels and mixed sentiment in derivatives markets before confirming a sustained bullish trend.

Dogecoin (DOGE) is showing encouraging signs of a potential reversal pattern known as the double bottom. As the broader crypto market faces downward pressure, DOGE has remained relatively stable around $0.21, hinting at a breakout attempt toward $0.25. This article dives into the technical signals and market data suggesting a possible bullish turn for the popular meme coin.

ALSO READ:XRP Surpasses Ethereum and Chainlink with Over 90% of Supply in Profitability

Dogecoin Consolidation Points to Reversal

On the 4-hour chart, Dogecoin has been trading sideways between roughly $0.2177 and the $0.25 resistance zone. The coin currently consolidates near the lower boundary of this range, facing a near-term resistance at $0.2302. This price action forms a classic double bottom pattern, where DOGE tests a support level twice before aiming higher.

Key technical indicators support this outlook. The MACD and signal lines are close to a bullish crossover, while bullish divergence on the MACD confirms upward momentum building within the double bottom pattern. However, the Supertrend indicator still flags a bearish trend, meaning DOGE must first break above $0.2349 to confirm a genuine reversal.

Fibonacci retracement analysis also highlights resistance at $0.2401, a key short-term hurdle before the coin can test the $0.25 supply zone. If this level is breached, the next target could be around $0.2680, based on Fibonacci extensions.

Mixed Sentiment in Derivatives Market

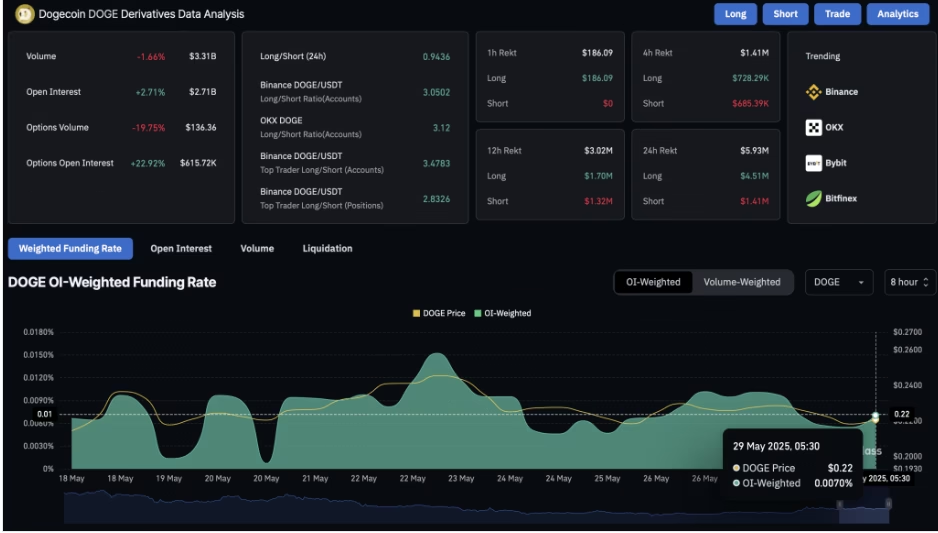

While technicals hint at optimism, derivatives data reveals a mixed sentiment among traders. Open interest in Dogecoin futures has risen 2.89%, now at $2.71 billion, signaling increased trader activity and anticipation of price movement.

The funding rate remains positive at 0.0070%, supporting bullish intent. However, recent liquidations tell a more nuanced story: long positions faced $4.51 million in liquidations over the last 24 hours, compared to $1.41 million for shorts. Despite this, the long-to-short ratio has increased from 0.915 to 0.945, with long positions now making up 48.59% of the market — a sign that bulls are regaining strength.

What’s Next for Dogecoin?

Dogecoin’s price must overcome several technical resistance points before confirming a sustained uptrend. If it breaks above $0.2349 and holds above $0.25, the meme coin could test higher levels near $0.2680. On the downside, support near $0.2177 and $0.2037 will be critical to watch for any sudden reversals.

Overall, DOGE shows resilience amid broader market weakness, and the developing double bottom reversal pattern may offer traders a bullish opportunity if confirmed.

ALSO READ:Can Pi Network Overcome Sell-Off Pressure After MEXC Listing?

DISCLAIMER:

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.