- Dogecoin is showing a familiar accumulation pattern similar to its 2017 breakout, with rising on-chain activity and increased holdings by smart money investors, suggesting a potential price surge if resistance is broken.

- However, retail investors remain bearish, and if the breakout fails, DOGE may continue its sideways movement.

Dogecoin (DOGE) is once again showing signs of repeating its historical patterns, leaving investors wondering whether a breakout is imminent. The meme coin has displayed a familiar accumulation phase, much like its 2017 price movement, hinting at a potential price surge. With on-chain activity rising and smart money showing interest, what’s next for DOGE?

Dogecoin’s Recurring Price Patterns

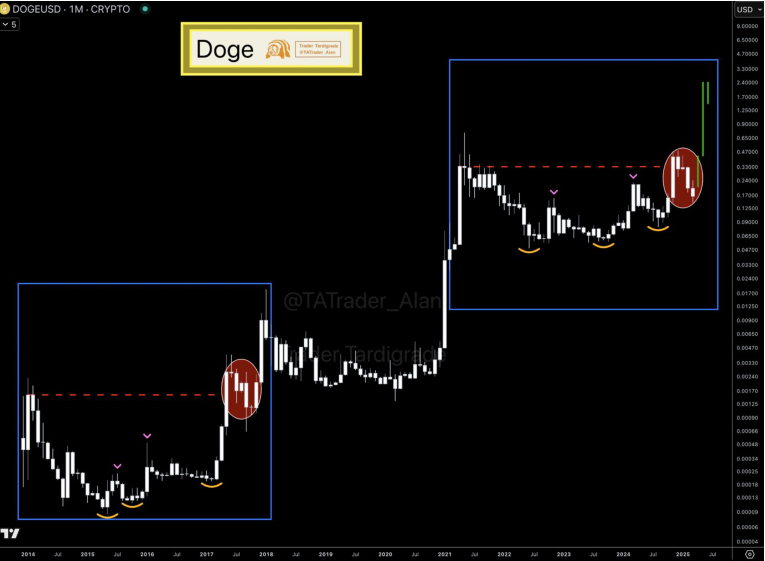

On the monthly timeframe, Dogecoin has been developing rounded bottoms near previous cycle highs. This pattern mirrors the 2017 breakout, where DOGE consolidated before surpassing resistance levels. A similar setup is forming now, with price movement creating multiple rounded bases followed by resistance rejection.

If history repeats itself, Dogecoin could soon break through key resistance levels, leading to a significant price surge. However, there is also a possibility that DOGE will continue trading sideways if the breakout fails to gain momentum.

Accumulation and On-Chain Activity Increase

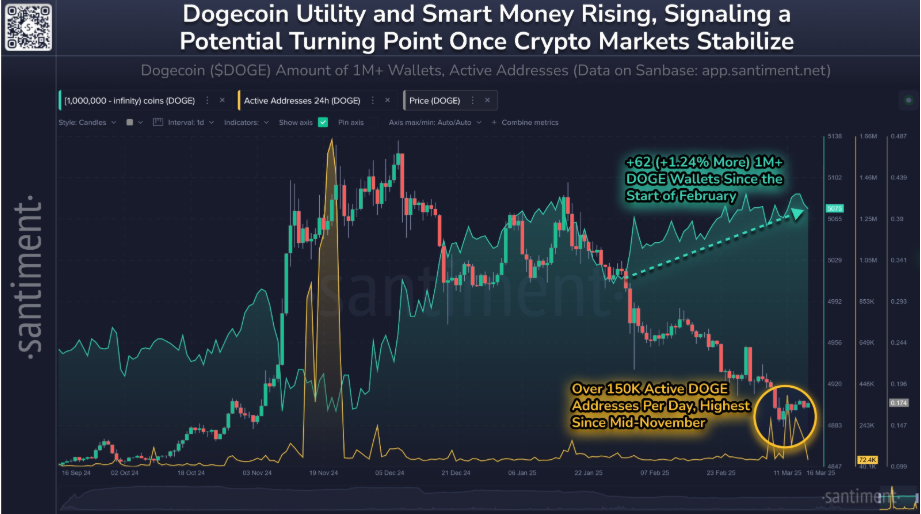

Despite recent price declines, on-chain activity for Dogecoin remains strong. Wallets holding at least 1 million DOGE have increased by 1.24% since early February, signaling accumulation by larger investors. Additionally, daily active addresses reached a four-month high of 150,000, indicating continued interest in the network.

This suggests that while retail investors may be losing confidence, institutions and seasoned traders see a buying opportunity. Rising network activity and accumulation by large holders could be early signs of a market shift.

Market Sentiment: Bearish Crowd vs. Bullish Smart Money

Market sentiment analysis reveals a split between retail investors and institutional players. The crowd sentiment index sits at -0.66, reflecting a bearish outlook from everyday traders who are reacting to price declines. On the other hand, ‘smart money’ investors, who typically make strategic moves, are measured at 0.33, indicating a bullish perspective.

This divergence suggests that experienced investors anticipate an eventual price recovery, while retail traders remain hesitant. Historically, smart money accumulation has preceded strong rallies in the crypto market.

Will Dogecoin Break Through Resistance?

The key level to watch is the red resistance line. A confirmed breakout with strong momentum could push DOGE towards its previous highs. However, if resistance holds, the price may continue its extended sideways movement.

For now, Dogecoin’s future hinges on whether buying pressure can overcome resistance. With increased on-chain activity, rising institutional interest, and historical price patterns aligning, a breakout may be just around the corner. Investors should keep a close eye on market movements to determine if this meme coin is ready for its next major rally.