- Ethereum’s price has plunged to $2,000 due to macroeconomic pressures, whale sell-offs, bearish technical patterns, and increasing competition from rivals like Solana.

- However, declining exchange reserves, institutional interest, and upcoming network upgrades suggest a potential recovery if key resistance levels are surpassed.

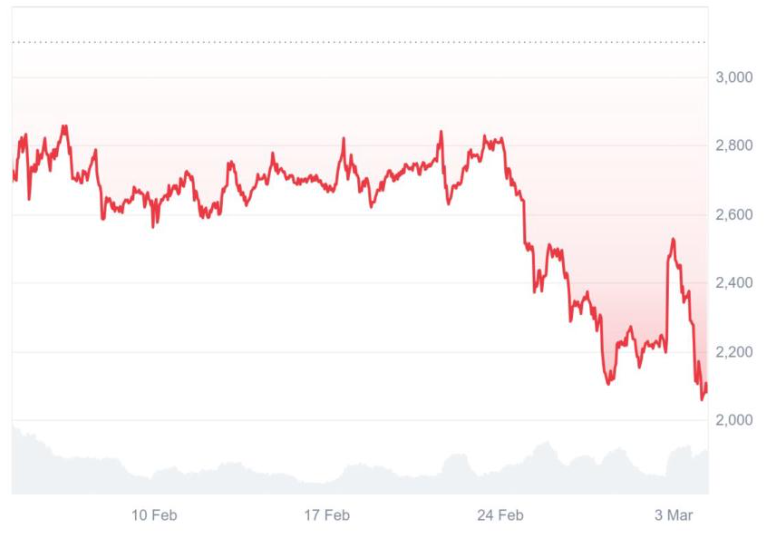

Ethereum (ETH) has been on a rollercoaster ride, experiencing extreme volatility that has left investors puzzled. The cryptocurrency, which recently surged by 14%, quickly lost momentum and plunged 15% the next day, testing its 16-month low at $2,000. With fears of a deeper crash looming, investors are left wondering: Why is Ethereum going down?

Key Reasons Behind Ethereum’s Decline

1. Macro-Economic Pressures and Market Sentiment

Global economic instability and geopolitical tensions have played a crucial role in Ethereum’s downward trend. Trade policies under former President Trump, including tariffs on key trading partners like China, Canada, and Mexico, have sparked uncertainty in financial markets. As investors move away from high-risk assets, cryptocurrencies like Ethereum are bearing the brunt of this sell-off.

2. Whale Activity and Liquidations

Ethereum’s price drop is also linked to massive sell-offs by major holders, often referred to as “whales.” On-chain data reveals that centralized exchanges hold a 12-month high of 16.2 million ETH, indicating increased selling pressure. Furthermore, the crypto market has seen significant liquidations, with ETH longs accounting for $168 million in losses over the past 24 hours.

3. Bearish Technical Patterns

Analysts point to bearish indicators, including the Moving Average Convergence Divergence (MACD) and the Relative Strength Index (RSI), which suggest further downside potential. If Ethereum fails to hold the $2,000 support level, technical projections indicate possible drops to $1,540 or even $1,000.

4. Increased Competition and Network Challenges

Ethereum’s dominance is under threat from competitors like Solana, which offers faster transactions and lower fees. Additionally, Ethereum’s transition to a proof-of-stake (PoS) model, initially aimed at making ETH deflationary, has not had the expected impact. Since April 2024, ETH’s supply has grown by 0.37%, contributing to investor concerns about long-term value retention.

Will Ethereum Recover?

Despite the recent downturn, Ethereum’s future isn’t entirely bleak. Several positive indicators suggest a potential rebound:

- Declining Exchange Reserves: Data from CryptoQuant shows a drop in ETH held on exchanges, indicating reduced selling pressure.

- Institutional Interest: Long-term investors continue to express confidence in Ethereum, with some analysts predicting a rally to $7,000 by the end of 2025.

- Proposed Network Upgrades: Ethereum’s upcoming upgrade, EIP-7781, aims to enhance network performance and restore ETH’s deflationary model, which could boost market sentiment.

What’s Next for Ethereum?

Ethereum’s recovery depends on various factors, including macroeconomic conditions, investor sentiment, and its ability to surpass key resistance levels like $2,800. While a drastic drop remains a possibility, Ethereum’s strong fundamentals in decentralized finance (DeFi) and smart contract applications suggest it still holds long-term potential.

For now, investors should keep a close eye on market trends and global developments to determine Ethereum’s next move.