- Ethereum price has surged above $2,900, driven by strong ETF inflows and growing corporate treasury investments.

- The breakout past $2,850 resistance sets the stage for a potential rally to $3,200, though a short-term pullback is possible.

Ethereum (ETH) has been making impressive gains recently, testing key resistance levels and showing strong bullish signals. After climbing above $2,900, ETH now eyes the $3,200 mark, fueled by significant inflows into Ethereum ETFs and increasing treasury investments. Here’s a closer look at the forces powering this rally and what could come next for the second-largest cryptocurrency.

ETF Inflows Power Ethereum Recent Rally

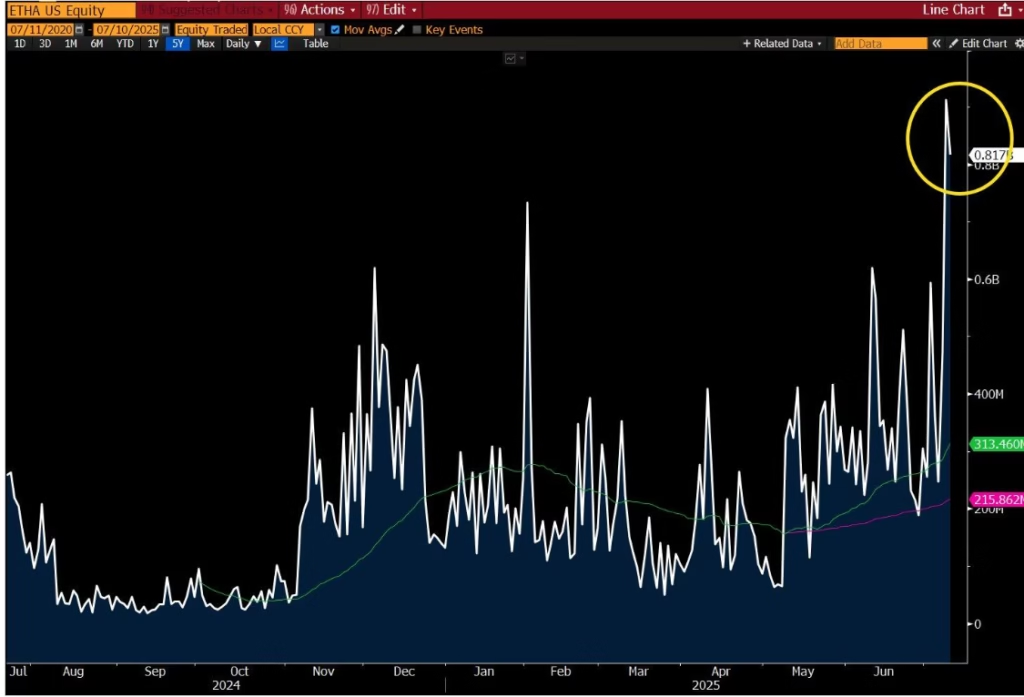

Ethereum’s price surge follows a wave of buying interest from exchange-traded funds (ETFs) and treasury allocations. US spot Ethereum ETFs have recorded net inflows of over $468 million in just four days, with BlackRock’s iShares Ethereum ETF (ETHA) showing particularly heavy trading volumes. According to Bloomberg analyst Eric Balchunas, ETHA’s daily volumes have quadrupled recently, signaling strong investor demand.

These ETF inflows represent a significant driver behind ETH’s recent momentum, supplementing the broader cryptocurrency market’s bullish trend, which was lifted by Bitcoin reaching new highs above $116,000.

Treasury Investments Add Fuel to the Fire

In addition to ETFs, major Nasdaq-listed companies are allocating capital to Ethereum treasury holdings. Since June, five firms including SharpLink Gaming, Bit Digital, and GameSquare have announced plans to hold over $1 billion worth of ETH combined. This growing institutional interest signals confidence in Ethereum’s long-term value and utility.

Further regulatory progress is supporting these moves. The US Senate recently passed the GENIUS stablecoin bill, which could accelerate the stablecoin ecosystem that heavily relies on Ethereum’s blockchain. If approved by the House, this legislation may boost demand for ETH-based stablecoin infrastructure.

Ethereum’s Technical Outlook: Testing Key Resistance Levels

Ethereum recently broke above a key $2,850 resistance level for the first time since early February. This breakout has fueled optimism for a further push toward $3,000 and possibly $3,200. However, technical indicators such as the Relative Strength Index (RSI) suggest that ETH is entering overbought territory, which means a short-term pullback could occur before the next leg higher.

If Ethereum fails to hold above $2,850, support near $2,500 may come into play, potentially cooling the rally.

Ethereum’s recent price surge is supported by robust ETF inflows and growing corporate treasury interest. Combined with positive regulatory signals and technical breakouts, ETH is well-positioned to test new highs near $3,200. While short-term volatility is possible due to overbought conditions, the overall outlook remains bullish as Ethereum continues to command a dominant position in the crypto market.

ALSO READ:Ethereum’s Road to $22K: Five Reasons to Invest Now

DISCLAIMER:

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.