- Ethena saw whale investors sell over 140 million tokens, worth approximately $107 million, last week.

- Despite the massive sell-off, Ethena’s price remains stable at $0.7638, up 3.17% in 24 hours.

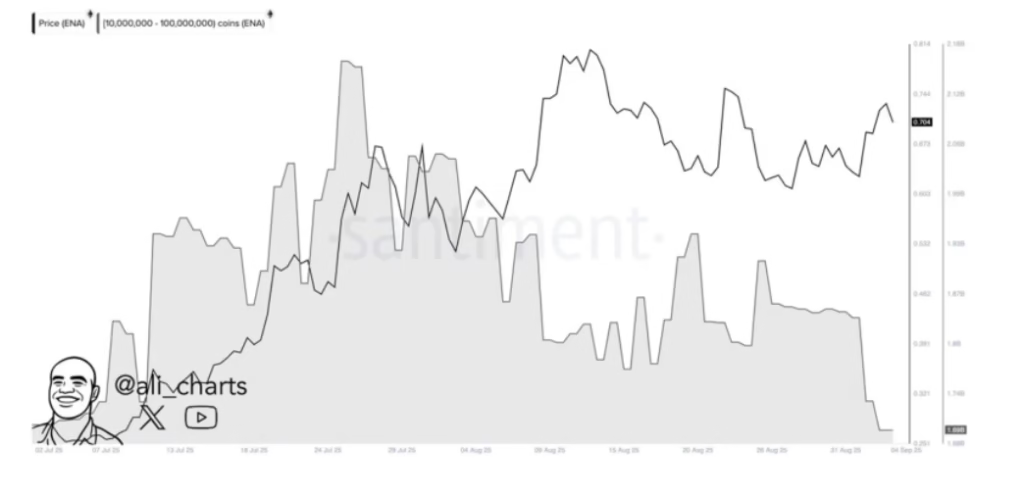

Whale investors recently sold more than 140 million Ethena (ENA), totaling approximately $107 million at current market prices. Crypto analyst Ali Martinez shared on X (formerly Twitter) that “last week whales sold 140 million Ethena,” highlighting the scale of the transaction. Despite this major sell-off, Ethena’s price has remained resilient, signaling continued investor interest.

Whales Offload $107 Million in Ethena

The large-scale sale by whale investors has drawn attention across the cryptocurrency community. Such transactions often influence short-term market trends, but in Ethena’s case, the sell-off did not significantly impact the token’s price, demonstrating its relative stability.

Ethena Price Holds Steady Amid Sell-Off

Currently trading at $0.7638 on the Binance USDT market, ENA has increased by 3.17% over the past 24 hours. The price movement suggests that retail investors and other market participants continue to support the token despite the massive liquidation by whales.

Investor Sentiment and Market Outlook

Reactions from traders remain mixed. While some interpret whale sales as a warning sign, others see an opportunity to buy at current prices. Ethena’s short-term performance will depend on broader crypto market trends, ongoing adoption, and investor confidence. Monitoring whale activity remains crucial for understanding potential price fluctuations.

The sale of 140 million Ethena tokens represents a significant market event, but the token has maintained stability. Keeping track of whale movements and market reactions will be essential for both new and experienced investors looking at ENA.

ALSO READ:Why Pi Network Could Collapse in 2026 and Are Investors Ready?

DISCLAIMER:

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.