- Ethereum ETFs have surpassed $16.5 billion in assets within a year, driven by strong inflows and growing institutional interest.

- With staking integration on the horizon, Ether is gaining ground as a serious investment option alongside Bitcoin.

Ethereum exchange-traded funds (ETFs) have officially celebrated their first anniversary—and they’re doing it in style. With over $16.5 billion in assets under management, the Ether ETF market is gaining traction, fueled by renewed investor interest, institutional backing, and the looming promise of staking integration.

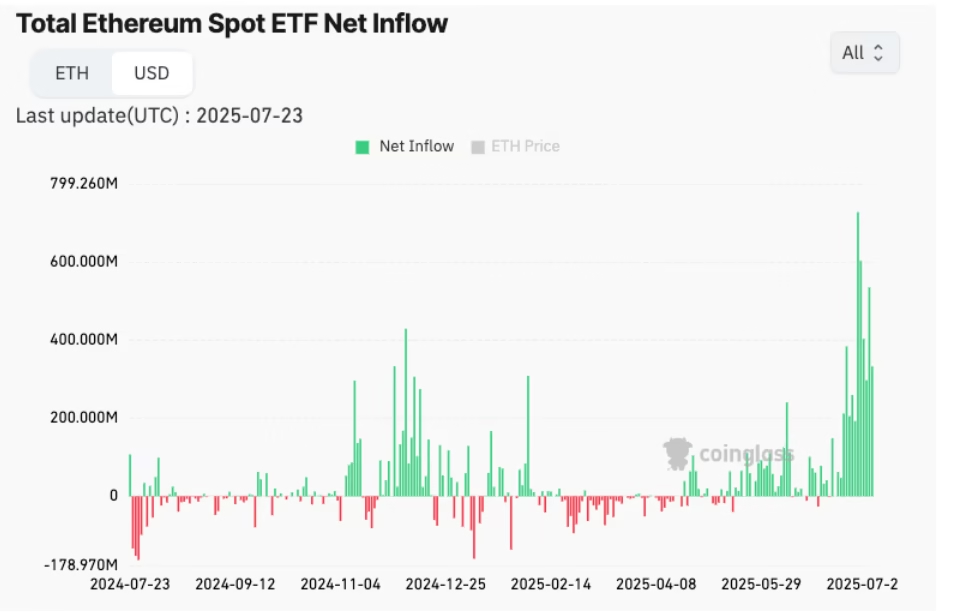

Ethereum ETF Inflows Surge

Since their approval by the U.S. Securities and Exchange Commission (SEC) on July 23, 2024, nine Ethereum ETFs have attracted $8.7 billion in new capital, with names like BlackRock, Fidelity, and Grayscale leading the charge. The past two weeks alone have seen 14 straight days of positive inflows, peaking at $726 million on July 16. Even the anniversary date brought in $332 million, underlining rising investor enthusiasm.

While Ethereum ETFs have long played second fiddle to Bitcoin ETFs, recent activity suggests that may be changing. Bitcoin still leads in total ETF inflows, with a massive $54 billion, but Ethereum is catching up—especially with new functionalities in the pipeline.

BlackRock Takes the Lead

BlackRock’s iShares Ethereum Trust ETF (ETHA) has emerged as the undisputed leader, raking in $8.9 billion in its first year. That success places ETHA not just at the top of Ethereum ETFs, but among the best-performing ETFs launched across the U.S. in 2024.

Spot ether ETFs began trading one year ago today…

Since that time, nearly 1,000 ETFs have launched.

iShares Ethereum ETF leads *all* of them in inflows w/ $8.5bil.

— Nate Geraci (@NateGeraci) July 23, 2025

By contrast, Grayscale Ethereum’s fund saw a net outflow of $4.3 billion, largely due to its structural transition and the narrowing discount between fund price and net asset value.

Staking May Be the Next Catalyst

The next game-changer? Staking integration. Staking allows investors to earn passive rewards while supporting the Ethereum network. Following Solana’s recent ETF launch with staking yields, experts believe Ethereum could be next.

The SEC has shown openness to this structure, and its approval would make Ether ETFs more appealing to long-term investors seeking yield as well as growth.

A Shift in Ethereum Market Sentiment

At the time of writing, Ether is trading around $3,600, up 8% from last year despite notable price swings. More importantly, institutional confidence appears to be growing. The ETF anniversary comes as a symbolic and strategic shift: Ethereum is no longer just the runner-up to Bitcoin—it’s a credible contender in its own right.

If staking becomes part of the Ether ETF framework, it could mark the start of a new chapter in crypto adoption and solidify Ethereum’s role in mainstream finance.

DISCLAIMER:

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.