- Ethereum is struggling to maintain its position as Bitcoin and Solana outperform amidst market turmoil.

- While Bitcoin benefits from its safe-haven status and Solana gains traction with faster speeds and lower fees, Ethereum faces challenges from its prolonged transition and regulatory pressures.

The Struggle for Ethereum

Ethereum (ETH) is experiencing significant challenges in the current turbulent cryptocurrency market. While Bitcoin (BTC) and Solana (SOL) have demonstrated relative resilience, Ethereum has faced increasing difficulties, underperforming against both its rivals.

The recent market downturn, marked by heavy sell-offs and widespread investor panic, has exacerbated Ethereum’s troubles. As BTC and SOL have managed to weather the storm more effectively, Ethereum’s price has struggled to maintain its footing. This divergence highlights the broader issues Ethereum is facing, particularly in comparison to its competitors.

Uncertain Transition and Investor Confidence

Several factors contribute to Ethereum’s underperformance. The protracted transition to Ethereum 2.0—a major upgrade intended to improve scalability and reduce energy consumption—has been a source of uncertainty for investors.

Despite its promises, the delay and ongoing challenges have eroded investor confidence, leading many to seek more immediate and reliable alternatives such as Bitcoin and Solana.

The narrative of Ethereum as “ultrasound money,” which suggests a deflationary asset that appreciates over time, has not gained the traction its proponents hoped for. Bitcoin’s established reputation as digital gold has overshadowed Ethereum’s attempts to carve out a unique identity. As a result, Ethereum has struggled to assert itself as a compelling investment option during market volatility.

Solana’s Technological Edge

Solana’s rapid rise has further impacted Ethereum’s market position. With its superior transaction speeds and lower fees, Solana has become a popular choice for developers and projects.

Notably, Solana played a pivotal role in the 2024 memecoin craze, demonstrating that developers are increasingly turning to alternatives outside of Ethereum’s ecosystem.

Regulatory pressures have also added complexity to Ethereum’s situation. Increased scrutiny on decentralized finance (DeFi) protocols, many of which operate on Ethereum, has fueled concerns about potential regulations, contributing to a negative sentiment surrounding the platform.

Market Trends and Value Disparity

Recent on-chain data indicates substantial movements of large ETH holdings, including those related to the PlusToken Ponzi scheme. Such activity has intensified fears of market disruption and further diminished Ethereum’s appeal.

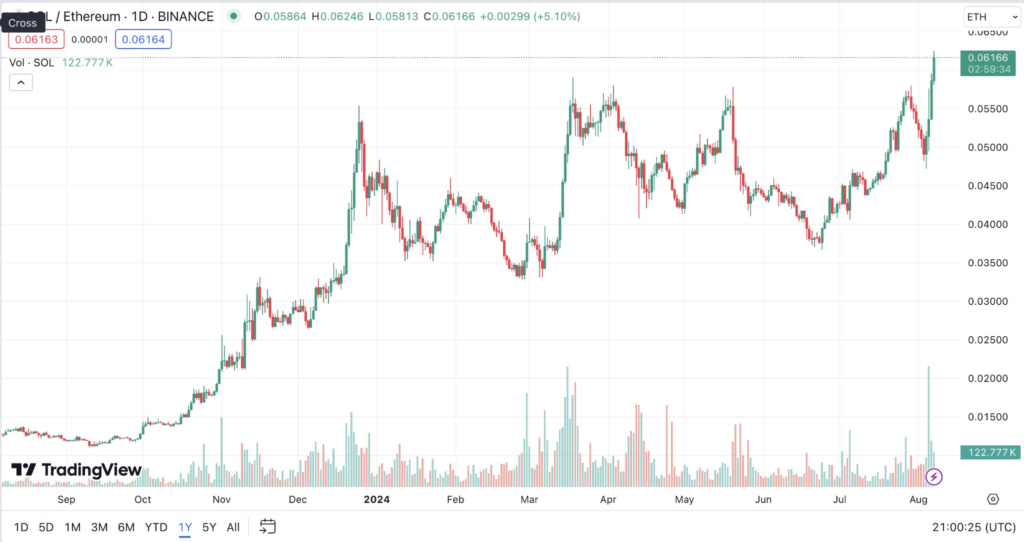

The BTC/ETH and SOL/ETH trading pairs reveal a stark contrast in value trends. The amount of Ethereum required to purchase one Bitcoin has surged to over 23 ETH, highlighting Bitcoin’s superior value growth. Similarly, the amount of Ethereum needed to buy one Solana has risen to above 0.061 ETH, underscoring Solana’s competitive advantage.

Despite the recent downturn, there is potential for Ethereum to recover. Following the market crash on August 6, Bitcoin and Solana have rebounded strongly, while Ethereum has continued its decline. However, the Ethereum token did show some recovery on August 8, climbing over 12%, though it remains close to its February 2024 levels.

Year-to-date, BTC and SOL have significantly outpaced Ethereum, with gains of 41.4% and over 54%, respectively, compared to Ethereum’s 13% rise.

The resolution of the SEC Ripple lawsuit could bring renewed optimism to the market and potentially help Ethereum close the gap with its competitors. For now, Ethereum faces an uphill battle as it contends with market pressures and competitive challenges.