- Ethereum has surged over 10%, driven by SEC Chair Paul Atkins’ supportive stance on DeFi regulation and rising investor demand.

- With strong ETF inflows, record staking levels, and bullish technical indicators, ETH is eyeing a breakout above $3,000 toward $3,250.

Ethereum (ETH) is back in the spotlight, surging more than 10% from recent lows and igniting investor optimism following remarks from SEC Chair Paul Atkins. At the time of writing, Ethereum trades near $2,780, after briefly touching $2,820 — its highest level since February.

Atkins’ DeFi Vision Fuels Ethereum Bulls

The rally finds its roots in a bullish statement by SEC Chair Paul Atkins during the final 2025 Crypto Task Force roundtable. Atkins clarified that staking, staking-as-a-service, and proof-of-work mechanisms do not fall under securities laws. He also applauded the robustness of smart contracts, signaling a friendlier regulatory outlook for decentralized finance (DeFi).

Atkins further revealed three possible regulatory routes: new guidance or rulemaking, amendments to existing regulations, and “innovation by exemption.” His message spurred renewed investor confidence in Ethereum’s role as a foundational layer of DeFi.

Derivatives and Staking Metrics Point to Strong Investor Demand

Ethereum’s derivative markets have surged in tandem. Futures funding rates have hit their highest point since May 23, and futures and options volume rose by 46% and 51%, respectively. Options skew has flipped decisively in favor of calls, reinforcing bullish sentiment.

Perpetual funding rates remain elevated, signaling continued buying pressure. Liquidations also surged, totaling $128.38 million in the past 24 hours, with short positions making up the bulk.

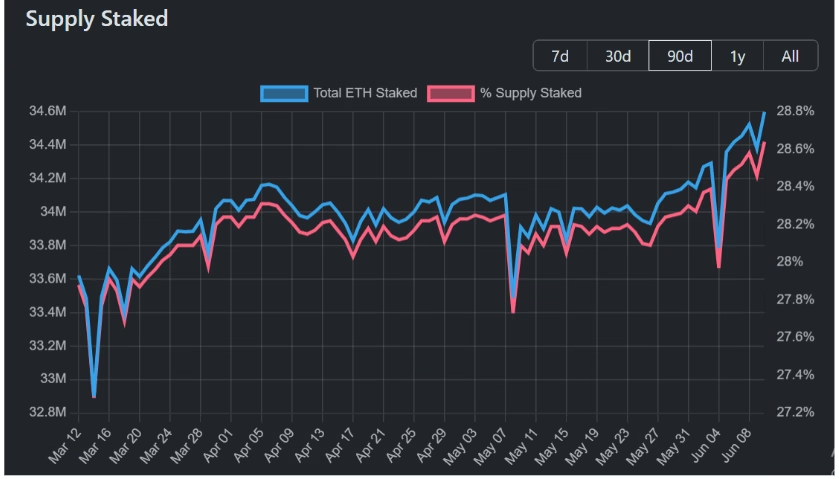

Meanwhile, staking protocols have reached an all-time high of 34.59 million ETH staked, according to Beacon.ch. This record aligns with growing enthusiasm around Ethereum’s long-term value proposition.

ETF Flows Add Another Bullish Layer

US spot Ethereum ETFs have now recorded 18 straight days of net inflows, outperforming their Bitcoin counterparts, which have seen mixed flows. Analysts interpret this shift as a sign of Ethereum’s growing reputation not just as an asset, but as a base layer for real-world tokenization.

ETH Technicals Signal Breakout Potential

Ethereum has climbed above both the 200-day Simple Moving Average and a key trendline resistance. If it holds this level, ETH could target $2,850, then push beyond the $3,000 psychological barrier, with an eventual test of $3,250.

The Relative Strength Index is nearing overbought territory, and the MACD is on the verge of a bullish crossover — further signs that ETH may be ready for another leg up.

As macro and technical factors align, Ethereum appears well-positioned to extend its gains, provided support at the 200-day SMA holds firm.

DISCLAIMER:

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.