- Ethereum is trading near $2,487 and forming a triangle pattern that suggests a breakout toward $3,300.

- A failure to break resistance could lead to a drop toward the $2,250 support zone.

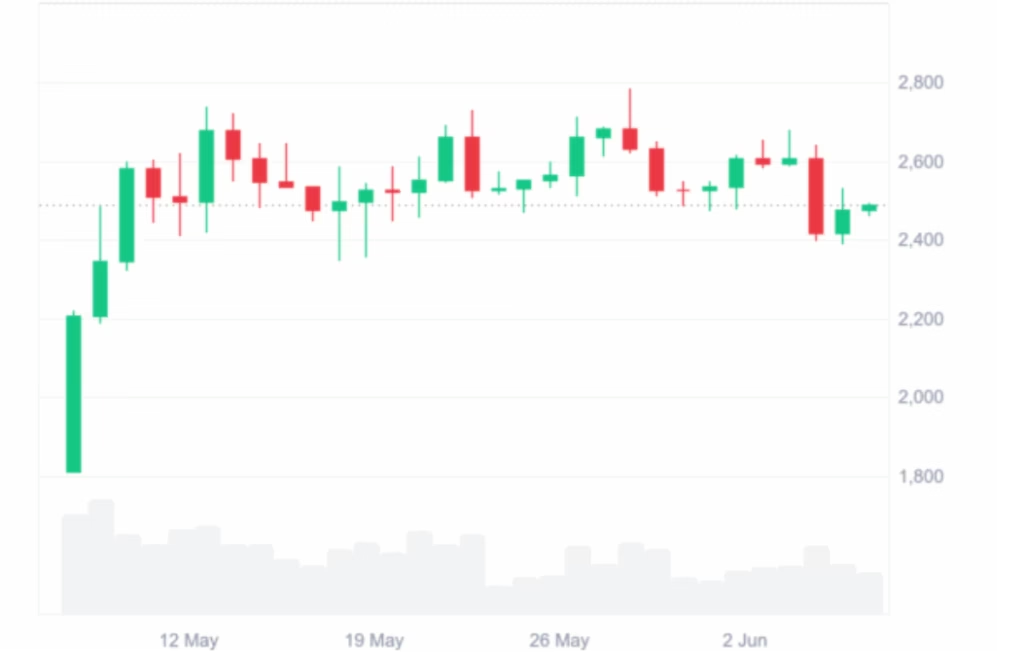

Ethereum continues to show strength as it trades near $2,487, gaining 2% in the last 24 hours and marking an impressive 30.45% increase over the past month. Analysts are closely watching a symmetrical triangle pattern forming on Ethereum’s 12-hour chart, a structure that often leads to a strong breakout in either direction.

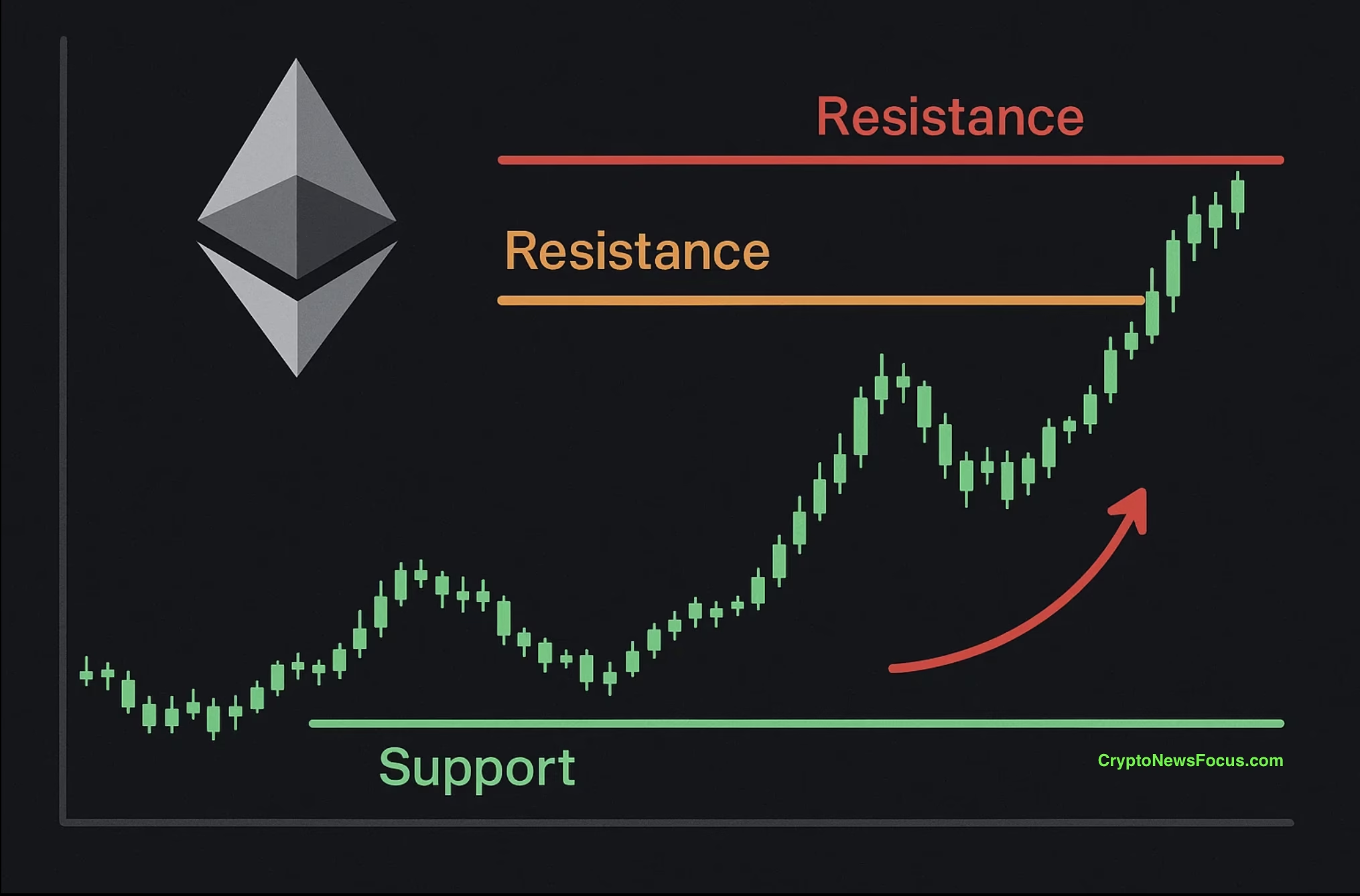

Resistance Zone in Sight: Will Ethereum Push Through?

The price action has recently tightened within this triangle, signaling growing indecision among traders. While the market remains cautious, Ethereum has bounced off support near $2,460 and is now testing the critical resistance zone between $2,670 and $2,700.

This area has triggered past sell-offs, but current technical conditions suggest a possible breakout is imminent. A successful breach above this range could set Ethereum on course toward the $3,300 level, based on the projected height of the triangle pattern.

ALSO READ:Trump vs. Musk Spat Sends Crypto Reeling, Then Rebounding as Market Shakes Off Drama

Traders Watching Key Levels as Market Awaits Confirmation

Despite recent gains, the market remains on edge. A failure to clear resistance might lead to a decline toward the $2,250 support region. The symmetrical triangle’s apex is approaching fast, and with it, a decision point for Ethereum’s next big move.

Ethereum’s resilience to the downside and a surge in both retail and institutional interest suggest underlying strength. However, investors are waiting for confirmation in trading volume to support a decisive breakout.

With a 24-hour trading volume of $17.05 billion and price action compressing within the triangle, Ethereum is setting the stage for its next major move—either a breakout toward $3,300 or a retracement to test lower supports.

Traders and analysts alike are keeping a close watch, knowing that the next move could define Ethereum’s path for weeks to come.

ALSO:Stellar (XLM) Sees 100% Spike in Transactions Amid Bullish Signals

DISCLAIMER:

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.