- Ethereum has fallen below $2,500 due to rising bearish pressure from upcoming option expiries, significant outflows from the chain, and strong resistance at key moving averages.

- These factors, combined with increased sell volume, suggest short-term volatility and the potential for further decline.

Ethereum has slipped below the critical $2,500 mark, triggering alarm across the crypto community. While it showed some bullish signs during the early Asian trading hours, Ethereum’s price quickly reversed, facing bearish pressure. But what exactly is behind this latest dip?

MIGHT ALSO LIKE:LUNC Token Burn Hits 73 Billion Yet Price Struggles to Recover

1. Ethereum Options Expiry Points to Bearish Trends

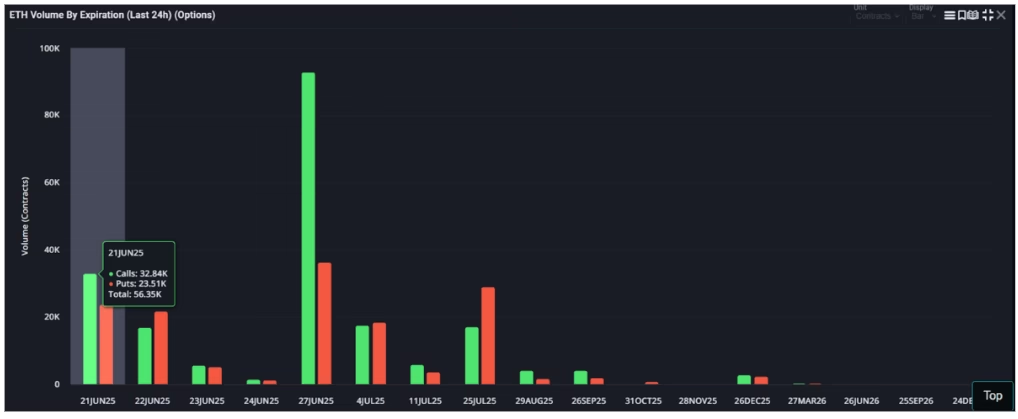

According to data from Laevitas, there’s been a surge in Ethereum option activity expiring on June 21, 2025, with over 56,000 contracts recorded. This includes a significant number of put options, indicating traders are hedging against further downside. The near-month expirations highlight heightened volatility and suggest possible market manipulation or sell-offs that could suppress Ethereum’s price further in the short term.

2. Rising ETH Outflows Signal Investor Exit

DefiLlama data reveals a steep outflow of ETH from the network. Since peaking at nearly 28 million ETH in early May, the figure has dropped to 25.22 million—a 10% decline in just 45 days. This significant reduction indicates that investors may be losing confidence in Ethereum or reallocating assets elsewhere, contributing to downward price pressure.

3. Technical Resistance and SMA Crossovers

Ethereum bulls are struggling to break past the 100-day and 200-day Simple Moving Averages (SMAs), which now act as strong resistance. The recent rejection at around $2,565 confirms this resistance zone, leading to increased liquidations. Moreover, a potential bearish crossover between these two SMAs could intensify selling in the near term. The volume spike during the latest decline further underscores the strengthening bearish grip.

What’s Next for Ethereum?

Ethereum is now hovering around $2,475, with immediate support lying at $2,384. If bearish sentiment continues, a drop to that support is likely. On the flip side, if bulls regain control, Ethereum could bounce back to $2,525, with further upside capped near $2,578.

As the market digests the option expiry and broader chain activity trends, Ethereum traders should brace for more volatility.

ALSO READ:Ondo and Stellar: The Perfect Crypto Pairing for 2025

DISCLAIMER:

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.