- Ethereum is holding steady above $1,600 as it gains attention for its potential role in decentralizing artificial intelligence, with projects like AI-driven agents and influencers already active on its network.

- Meanwhile, the SEC has delayed its decision on ETH staking ETFs, though technical analysis shows bullish potential if resistance levels are broken.

Ethereum (ETH) is holding steady above the $1,600 mark, showing signs of resilience even amid broader market uncertainty. Over the past 24 hours, ETH has gained 1.2%, a modest but meaningful move as discussions intensify around Ethereum’s evolving role in artificial intelligence (AI) development. With growing institutional interest and new technological use cases emerging, Ethereum appears to be navigating a phase of both technical consolidation and visionary expansion.

AI and Ethereum: A Promising Intersection

The next major chapter in Ethereum’s evolution may very well lie in AI. Former Ethereum developer Eric Connor recently highlighted the blockchain’s potential to address critical issues plaguing modern AI systems. These include black-box model opacity, centralized data silos, and major privacy concerns. Connor believes Ethereum’s transparent smart contract architecture can provide verifiable, decentralized documentation for AI training methods and data sources, offering a way forward in an increasingly data-sensitive world.

Ethereum’s AI integration isn’t just conceptual. Real-world examples are already in motion. Projects like Luna, an AI-driven virtual influencer with its own wallet, and Botto, a community-guided AI artist creating NFTs, show how AI agents are thriving on Ethereum. Others like AIXBT and HeyAnon are also streamlining blockchain interactions, bringing user-friendly AI interfaces to crypto markets and wallets alike.

Regulatory Hurdles Persist

Despite these technological strides, Ethereum faces lingering regulatory challenges. The U.S. Securities and Exchange Commission (SEC) recently delayed its decision on allowing ETH staking in Grayscale’s Ether ETFs until June 1, with a final deadline set for October. If approved, staking could enhance ETF appeal by offering annual yields of 2% to 7%—an enticing prospect for passive investors.

While staking remains in limbo, the SEC has greenlit options trading for several spot Ether ETFs, including those from BlackRock, Bitwise, and Grayscale. These moves mark progress but underline the cautious stance regulators are taking.

Technical Outlook: Consolidation with Upside Potential

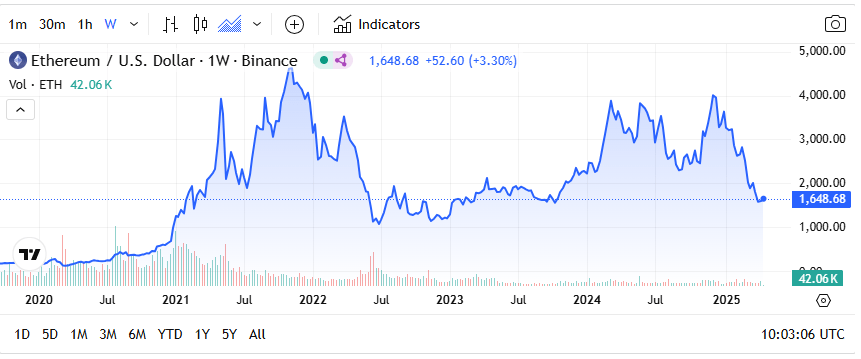

From a technical standpoint, Ethereum appears to be in a consolidation phase after peaking at $1,690. Support is strong around $1,625, with ETH trading above both this level and the 100-hourly Simple Moving Average (SMA). Immediate resistance lies at $1,656 and $1,680, and a successful breakout could pave the way for a move toward $1,750 and even $1,880.

On the downside, if momentum falters, ETH may revisit support zones at $1,610 or $1,575. Still, with its growing relevance in AI and expanding institutional interest, Ethereum’s foundation remains strong.

As the line between blockchain and artificial intelligence continues to blur, Ethereum is positioning itself at the heart of a technological convergence that could define the next era of digital innovation.

DISCLAIMER:

The views and opinions expressed herein are solely those of the author or advertiser and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.