- Ethereum remains resilient above $1,800, driven by the launch of Privacy Pools, which enhance transaction privacy while ensuring regulatory compliance, and strong activity on the Base layer-2 scaling solution.

- Overcoming resistance at $1,850 could drive ETH higher, while long-term growth depends on real-world adoption and increased network usage.

Ethereum (ETH) continues to hold strong above the $1,800 support level, showing resilience despite market fluctuations. This stability is attributed to significant ecosystem developments, including the launch of Privacy Pools and robust activity on its layer-2 scaling solution, Base.

Privacy Pools: A New Era of Transaction Privacy on Ethereum

Privacy Pools, a semi-permissionless privacy tool developed by 0xbow.io, offers users a way to make private transactions while proving their funds are not linked to illegal activities. Backed by Ethereum co-founder Vitalik Buterin, who made an initial deposit of one Ether, Privacy Pools addresses longstanding privacy concerns by anonymizing transactions through “Association Sets.”

The tool enforces regulatory compliance by screening out illicit funds, making it a potential game-changer for privacy-conscious users. This innovation aims to “Make Privacy Normal Again,” reinforcing Ethereum’s commitment to privacy without compromising legal standards.

Layer-2 Solution Base Shows Impressive Performance

Ethereum’s layer-2 scaling solution, Base, is making waves with an impressive 6.9 million daily transactions. Despite broader market skepticism, Base’s activity highlights Ethereum’s ability to handle a high volume of transactions efficiently. With Base leading in value transferred and trading costs among its peers, the solution is critical to Ethereum’s scalability and decentralized application (dApp) support.

Technical Analysis: Ethereum Faces Key Resistance Levels

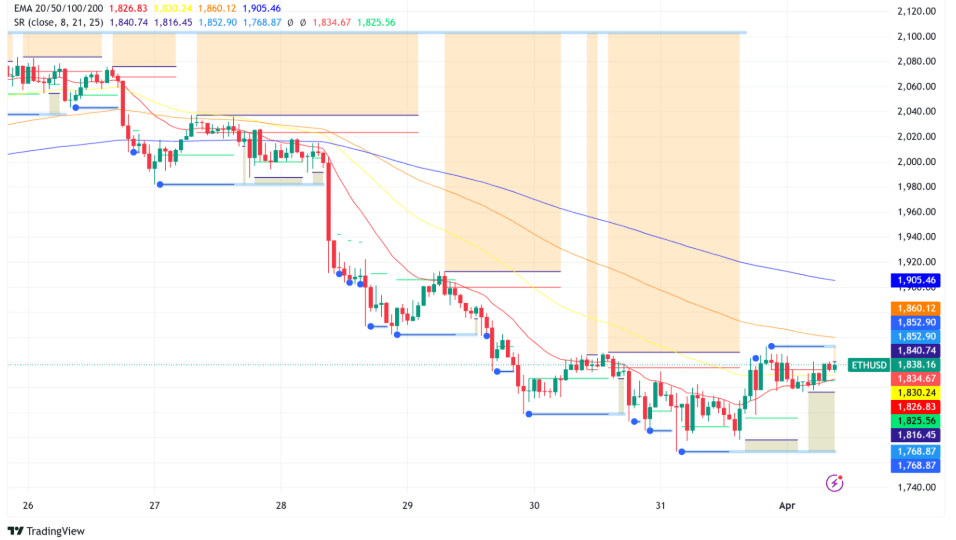

Ethereum faces immediate resistance at $1,850, with further barriers at $1,880 and $1,900. Breaking through these levels could push ETH towards the $2,000 mark, while failure to maintain $1,800 support may signal a bearish continuation, potentially dropping to $1,780 or even $1,656. However, the current RSI indicates potential momentum, while MACD trends show signs of recovery.

Real-World Adoption and Long-Term Value

Ethereum’s future price potential relies heavily on real-world adoption. Investor Ryan Berckmans believes ETH could reach $20,000 if network usage increases and layer-1 and layer-2 applications improve. Despite short-term holder capitulation, whales are accumulating, suggesting long-term confidence in the network.

A Promising Yet Challenging Road Ahead

Ethereum’s ecosystem developments, including Privacy Pools and the Base network, reflect ongoing efforts to strengthen privacy and scalability. While resistance at $1,850 presents a hurdle, breaking past it could lead to significant gains. With continued adoption and scaling solutions, Ethereum remains a pivotal force in the crypto space, poised for long-term growth.