- Ethereum is holding key support near $4,200, which could trigger a rally toward $8,000 or a drop to $3,900.

- Institutional inflows, Layer 2 growth, and staking trends continue to support its long-term upside.

Ethereum (ETH) is trading near $4,280, pulling back from recent highs of $4,776. The cryptocurrency now faces a crucial test at the $4,200 support level, which could determine whether ETH launches toward new highs or experiences a deeper correction.

From Recent Highs to Key Ethereum Support

Last week, Ethereum briefly touched $4,776, just below its 2021 all-time high of $4,878, before dropping roughly 6% to the $4,200–$4,280 range. Analysts caution that short-term charts show lower highs and lower lows, signaling temporary bearish pressure, even as the daily chart maintains a bullish structure with higher highs and higher lows.

Crypto analyst Michaël van de Poppe notes that the ideal buying opportunity may have already passed. He advises waiting for a correction near $4,200–$3,800 before targeting levels above $5,000, highlighting the importance of these key support zones.

Institutional Demand Drives Momentum

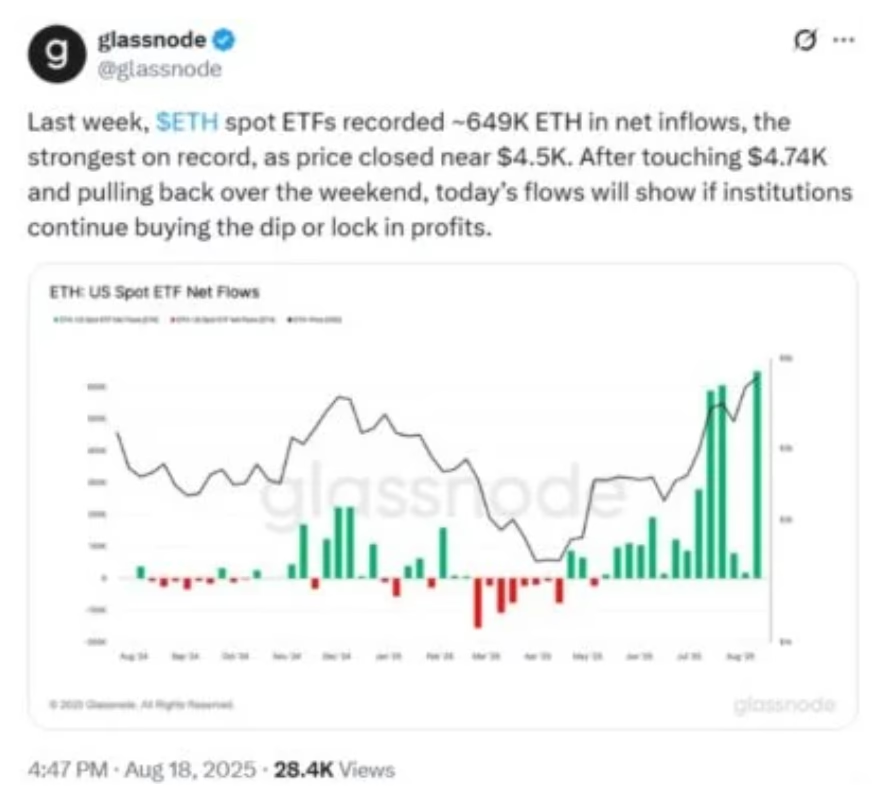

Institutional interest remains robust, with U.S.-listed spot Ether ETFs recording nearly 649,000 ETH in net inflows last week—the largest weekly inflow ever. Bloomberg ETF analyst Eric Balchunas emphasized that Ethereum ETFs are making Bitcoin the “second-best crypto asset” due to heavy investor demand. Such inflows indicate sustainable long-term interest and a rally supported by spot buying rather than leveraged positions.

Technical Setup and Potential Breakouts

Immediate support for Ethereum sits around $4,150–$4,200, with additional bids near $3,900. Resistance levels are found at $4,400 and $4,583, with a potential retest of $4,776 if ETH breaks through. A sustained rally could set Ethereum on a path toward $8,000.

Source: @CryptoMichNL via X

The four-hour RSI below 50 suggests room for a short-term decline, but analysts highlight that smart money continues to absorb dips, reinforcing the bullish case.

Layer 2 Adoption Strengthens Ethereum

Ethereum’s Layer 2 networks, including Arbitrum, Optimism, and zkSync, are seeing record transaction volumes, reducing gas fees and enhancing accessibility. With Layer 2 total value locked surpassing $40 billion, these developments could support Ethereum’s long-term valuation as it competes for capital with Bitcoin.

Bullish or Bearish Path for Ethereum

Ethereum stands at a crossroads. A strong bounce from the $4,200 support could drive ETH toward the $8,000 target, while a breakdown may trigger a drop toward $3,900.

Source: @CryptoJelleNL via X

With institutional inflows, Layer 2 adoption, and staking fundamentals in place, the market will closely watch whether this support becomes a launchpad for the next major rally.

ALSO READ:IOTA Enables EV-to-Grid Energy Swaps to Cut Costs and Boost Reliability

DISCLAIMER:

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.