- Ethereum reached a record $4,957 in August, but network revenue fell 44% due to reduced transaction fees after the Dencun upgrade.

- Despite the decline, analysts predict strong growth, with targets of $5,500 near-term and $12,000 by year-end.

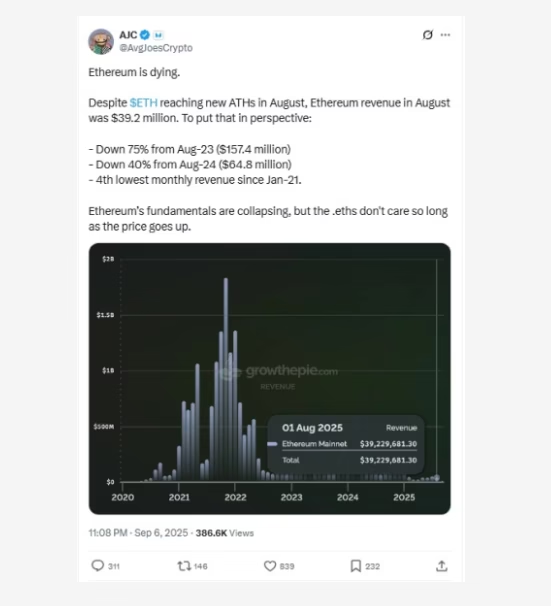

Ethereum (ETH) reached an all-time high of $4,957 in August, signaling strong market confidence. Yet, the network’s on-chain revenue fell sharply by 44%, highlighting the mixed signals Ethereum is sending to investors.

Network Fees Fall After Dencun Upgrade

Ethereum’s recent Dencun upgrade, implemented in March 2024, significantly lowered transaction costs for layer-2 rollups. While this move benefits users with cheaper transactions, it caused layer-1 fee revenue to drop from $49.6 million in July to $39.7 million in August, contributing to the overall 44% revenue decline.

Critics worry about Ethereum’s long-term revenue sustainability. However, supporters argue that this change reflects Ethereum’s maturation into an essential financial infrastructure rather than a high-fee blockchain. Lower fees may reduce short-term revenue but could drive broader adoption among institutional and retail users alike.

Ethereum Price Predictions Point to a Potential Rally

Despite the revenue decline, Ethereum’s price continues to attract bullish predictions. Co-founder Joseph Lubin believes ETH could experience a 100x rally, positioning it as a core infrastructure for Wall Street as traditional finance gradually decentralizes.

Fundstrat analyst Tom Lee also projects strong growth, targeting $5,500 in the near term and $12,000 by the end of the year. Wall Street sentiment has improved following the Senate’s passage of GENIUS Stablecoin legislation, and Ethereum already supports over $145 billion in stablecoin supply.

Transitioning from Fees to Foundational Infrastructure

The revenue drop may matter less as Ethereum evolves from a high-fee blockchain to a foundational layer for decentralized finance. This shift could cement ETH’s role in the broader financial ecosystem, potentially attracting long-term institutional investments.

While the decline in fees raises concerns, Ethereum’s record-breaking price and adoption by major financial institutions underscore its growing influence. Investors should weigh short-term revenue fluctuations against Ethereum’s long-term potential as a cornerstone of decentralized finance.

DISCLAIMER:

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.