- Ethereum dropped 4.6% to $4,380, pressured by technical breakdowns, profit-taking, and macroeconomic uncertainty.

- Investors are closely watching key support near $4,180 and upcoming Fed announcements for market direction.

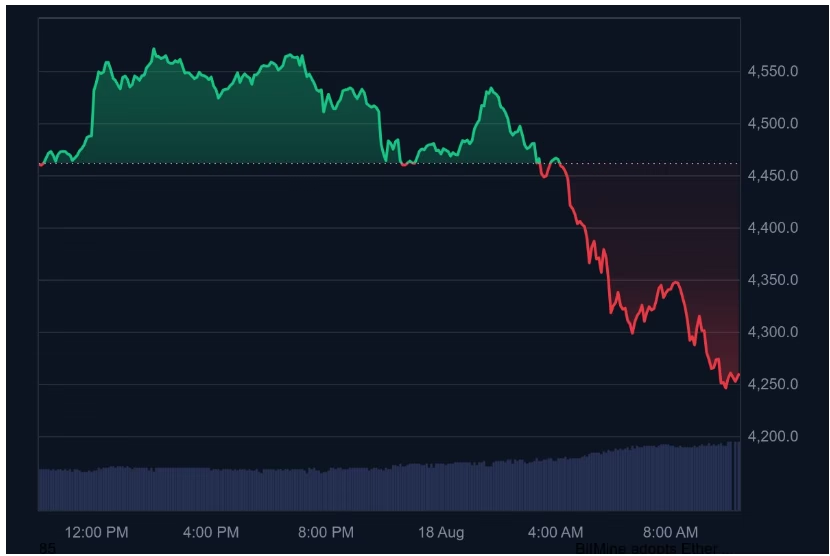

Ethereum (ETH) experienced a sharp decline of 4.59% over the past 24 hours, falling to $4,380 and underperforming the broader crypto market, which saw a 2.92% drop. The downturn comes amid a mix of macroeconomic concerns, technical sell-offs, and profit-taking by traders.

Ethereum Macroeconomic Pressures Weigh on Crypto

Stronger-than-expected U.S. inflation data dampened expectations for aggressive Federal Reserve easing, with markets now pricing in only a 25-basis-point rate cut in September. Geopolitical tensions further amplified uncertainty after U.S.-Russia talks over Ukraine stalled, and former President Trump’s meeting with Volodymyr Zelensky drew market attention.

These macro headwinds have hurt risk appetite, pushing investors toward traditional safe-haven assets. Gold rose 1.2% as Ethereum and other risk assets fell. The close correlation between ETH and Bitcoin, which dropped 2.5%, intensified Ethereum’s sell-off. Traders are now closely monitoring Fed Chair Jerome Powell’s upcoming speech at Jackson Hole for hints on future monetary policy.

Technical Breakdown Spurs Liquidations

Ethereum’s chart also painted a bearish picture. ETH fell below its 23.6% Fibonacci retracement level at $4,450 and its pivot point at $4,483, breaking the recent bullish structure. Momentum indicators cooled, with the Relative Strength Index (RSI) dropping to 66.7 from prolonged overbought conditions.

This technical weakness triggered cascading liquidations, putting $1.19 billion in long positions at risk if ETH dips below $4,400. Analysts are eyeing the $4,180 level, near the 76.4% Fibonacci retracement, as a critical support where bulls may attempt to defend against further losses.

Profit-Taking and ETF Outflows Increase Selling Pressure

Institutional sentiment added to the downward pressure. Ethereum spot ETFs recorded $152 million in withdrawals on August 18, signaling cooling appetite from funds after weeks of strong inflows. Whale activity also raised concerns, with Ethereum co-founder Jeffrey Wilcke moving 5,200 ETH (approximately $9.57 million) to exchanges.

Overall, Ethereum’s recent slide reflects a convergence of macroeconomic uncertainty, technical breakdowns, and strategic profit-taking. Investors are now watching key support levels and upcoming Fed announcements to gauge whether ETH can stabilize or face deeper losses in the near term.

ALSO READ:IOTA TVL Surges to $36M as Token Eyes $0.50 Breakout.

DISCLAIMER:

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.