- Ethereum price is testing a crucial $4,000 resistance level after rising over 24% in the past week.

- Breaking this barrier could lead to higher price targets and increased demand for advanced crypto trading tools.

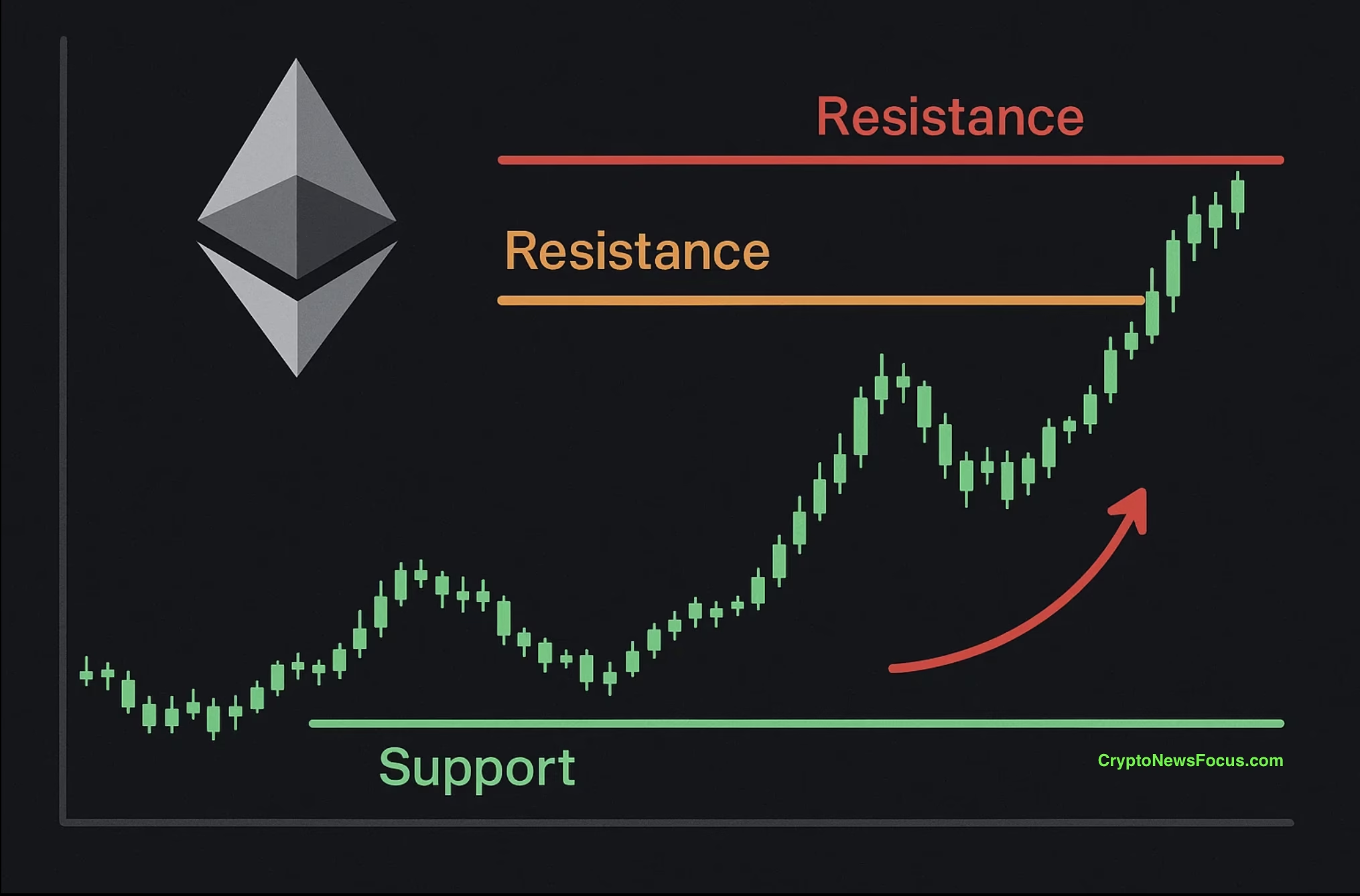

Ethereum price has shown significant strength lately, rising over 24% in the past week. After a period of consolidation around support levels, Ethereum (ETH) is now pushing toward a critical resistance level near $4,000. This milestone is eagerly watched by traders and analysts as a potential gateway to new highs.

Ethereum Breaks Above Key Technical Zones

Currently trading above $3,565, Ethereum has already surpassed an important intraday level. It has also cleared $3,714, which previously acted as a strong resistance point. Holding above these zones signals sustained bullish momentum.

#Ethereum 0.886 log fib is the final boss before it can go up that much higher pic.twitter.com/PaG9B3bzlm

— Cantonese Cat 🐱🐈 (@cantonmeow) July 20, 2025

The critical resistance Ethereum now faces sits at $4,005, aligning closely with the 0.886 Fibonacci retracement level—a key indicator often used to predict price reversals or breakouts. If ETH convincingly breaks through this $4,000 barrier, it could pave the way for higher price targets.

Support Levels and What They Mean for Bulls

On the downside, the primary support to watch is at $3,541. Falling below this level might signal weakening bullish momentum and could invite a short-term correction. Historically, Ethereum has found solid buying interest at Fibonacci levels 0.5 ($2,069) and 0.618 ($2,532), which have acted as support zones during past price dips.

Potential Targets Beyond $4,000

Should Ethereum succeed in breaking through $4,000, the next major resistance points become relevant. These include the previous all-time high near $4,867, and even more ambitious Fibonacci extension levels at $7,752 and $9,883. While these are longer-term targets, breaking past $4,000 would mark a significant turning point toward renewed bullish trends.

What Ethereum Rise Means for Crypto Tools

An increasing Ethereum price is likely to boost demand for advanced trading tools and platforms. For instance, Best Wallet, known for its exclusive crypto analysis and alpha trading calls, could see increased interest. As traders seek to maximize profits amid a bullish market, services offering strategic insights like Best Wallet could experience a surge in user activity and token price.

ALSO READ:What Is Ethereum 2.2 Staking? (Stake Ethereum 2.0)

DISCLAIMER:

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.