- Ethereum has dropped below $1,600, losing over $2.5 billion in value as investor confidence weakens and rivals gain ground.

- With technical indicators showing uncertainty and on-chain activity stagnating, ETH faces a critical test to hold support or risk a deeper correction.

Ethereum has slipped into dangerous territory once again, crashing below the critical $1,600 mark and shedding over $2.5 billion in value. As investor confidence wavers and rivals gain momentum, the second-largest cryptocurrency finds itself at a crucial turning point.

Bearish Sentiment Dominates as Ethereum Struggles

Despite recent upgrades to the network, Ethereum is underperforming. Trading volumes are thinning, on-chain activity is stagnating, and capital is flowing toward faster, cheaper blockchains. Even the ETH/BTC pair has weakened, highlighting a shift in dominance as traders increasingly look to alternative Layer-1s and Layer-2s for better performance.

The situation was worsened by the unexpected market reaction to a regulatory rollback in the DeFi space. Instead of fueling optimism, the move triggered fresh capital outflows. Ethereum’s once-dominant position in decentralized finance is now shrinking, making investors question its long-term edge.

Technical Indicators Signal Uncertainty

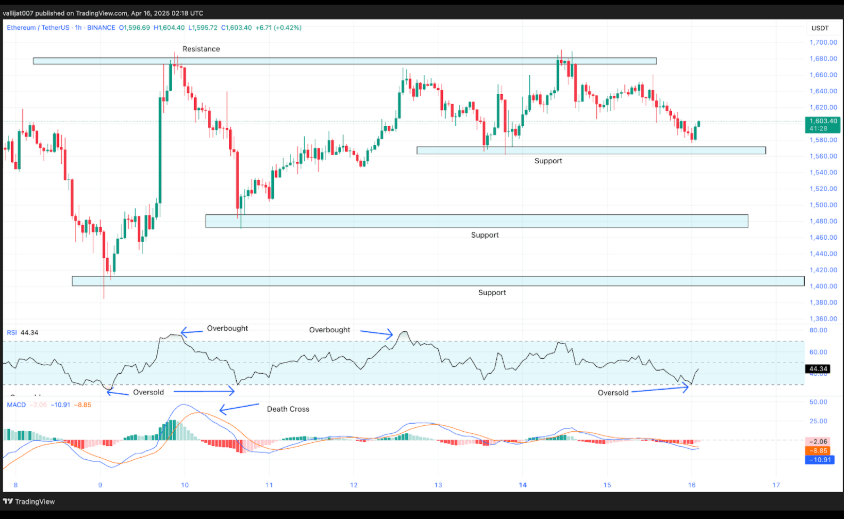

At the time of writing, Ethereum is hovering around $1,603 and attempting to stabilize above short-term support near $1,580. However, resistance looms overhead at $1,690, a level that has consistently rejected bullish breakouts in recent weeks.

The Relative Strength Index (RSI) is climbing from oversold levels and currently sits at 44.34, hinting at the potential for a short-term recovery. But with the MACD still in negative territory—despite declining bearish momentum—the broader trend remains fragile. A breakdown below $1,580 could open the door to deeper levels at $1,500 or even $1,420.

Ethereum’s Tipping Point

Ethereum is clearly at a crossroads. Its dominance is eroding, and without a decisive shift in market sentiment or on-chain engagement, the path forward looks uncertain. To regain strength, ETH needs more than just a technical bounce—it needs renewed user activity, stronger fundamentals, and a clear narrative to compete with its rising rivals.

Until that happens, traders are likely to remain cautious. A failure to hold current support levels could lead to the steepest correction ETH has seen in years. The next few days may prove critical as Ethereum tries to defend its reputation—and its price—in an increasingly competitive crypto landscape.

DISCLAIMER:

The views and opinions expressed herein are solely those of the author or advertiser and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.