- Ethereum has surpassed $100 billion in staked ETH, with over 32.8 million tokens locked, reflecting strong long-term investor confidence.

- At the same time, investors are sending fewer ETH to exchanges, reducing selling pressure and supporting the recent price rise.

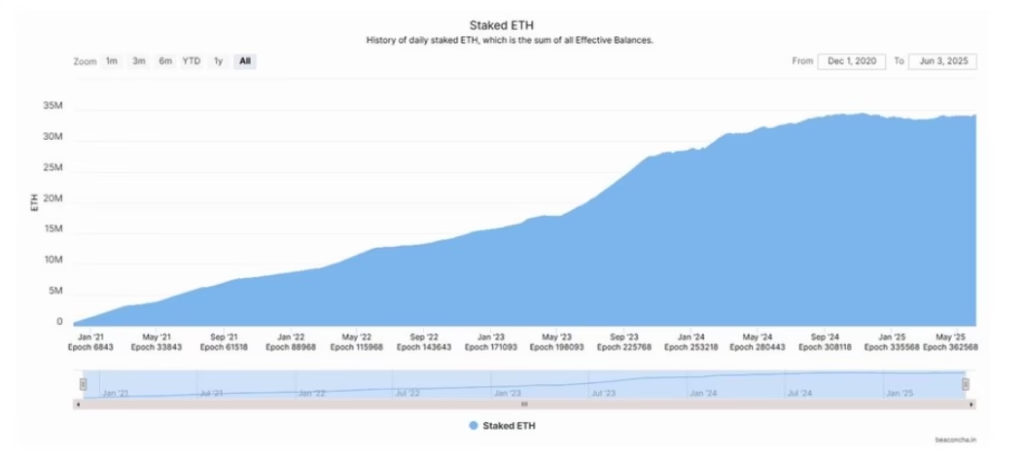

Ethereum’s staking ecosystem has reached an unprecedented milestone, with more than 32.8 million ETH currently locked in staking contracts — a staggering value exceeding $100 billion. This surge in staking reflects growing investor confidence in Ethereum’s long-term potential and signals a notable shift in market dynamics.

ALSO READ:What Could Make or Break Pi Network in the Coming Weeks?

Ethereum Staking Growth Reflects Strong Investor Belief

According to crypto analyst Merlijn The Trader, the rise in Ethereum staking is a clear indicator that “smart money” investors are increasingly buying and locking up ETH rather than engaging in short-term speculation. While many in the crypto space remain focused on volatile meme coins and high-risk bets, these serious investors are quietly accumulating Ethereum and staking it, effectively taking it out of circulation.

This growing trust in Ethereum is often overlooked but could have significant implications. The steadily increasing number of staked ETH tokens supports the narrative that many investors are betting on the network’s future growth rather than quick profits. This behavior correlates with the recent price appreciation of ETH, which has climbed to around $2,490.

Less ETH on Exchanges Signals Reduced Selling Pressure

Supporting the staking data, CryptoQuant revealed a sharp decline in the amount of Ethereum being transferred to exchanges. Between June 6 and June 7, ETH deposits to exchanges plummeted from over 900,000 to just about 173,200 tokens. Typically, a high volume of ETH sent to exchanges indicates potential selling pressure as investors prepare to offload their holdings.

The significant drop in Ethereum inflows to exchanges suggests that fewer holders are looking to sell, aligning with the surge in staking activity. As a result, the circulating supply of ETH available for trading has decreased, which often acts as a bullish factor for price stability and growth.

What This Means for Ethereum’s Future

The combined effect of massive staking and reduced exchange supply reflects a growing conviction in Ethereum’s value and technology. Investors locking up over $100 billion in ETH indicate confidence in the network’s roadmap, including scalability upgrades and DeFi growth.

In summary, Ethereum’s record-breaking staking figures and declining exchange supply reveal a market increasingly focused on long-term holding and ecosystem development. This shift is likely to support ETH’s price stability and could contribute to further gains in the months ahead. For those watching the crypto space, these trends signal that Ethereum remains a cornerstone of smart investment strategies.

ALSO READ:XRP Jumps 10% as Bull Flag Breakout Targets 50% Rally

DISCLAIMER:

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.