- Ethereum whales purchased over $2.5 billion worth of ETH on June 15, marking the highest daily accumulation since 2018.

- This surge, combined with institutional inflows and a 2017-like chart pattern, has analysts predicting a breakout toward $4,000 or even $10,000.

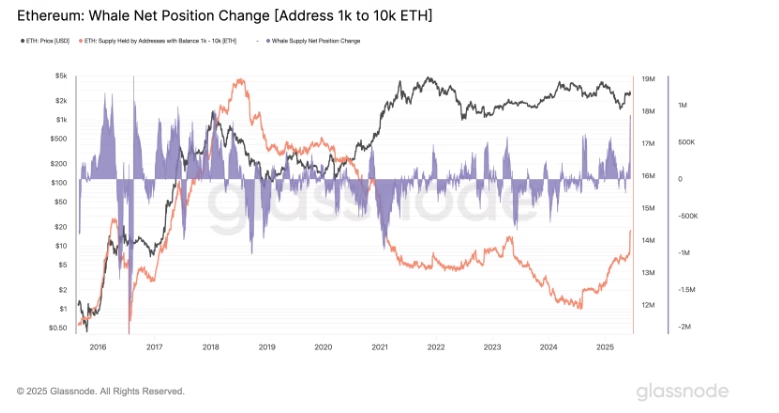

Ethereum’s biggest players are making bold moves. On June 15, wallets holding between 1,000 and 10,000 ETH added over 818,000 ETH — worth roughly $2.5 billion — in a single day. This marks the largest daily inflow for this cohort since 2018. These so-called Ethereum whales now hold more than 16 million ETH, up from 11.87 million ETH a year ago.

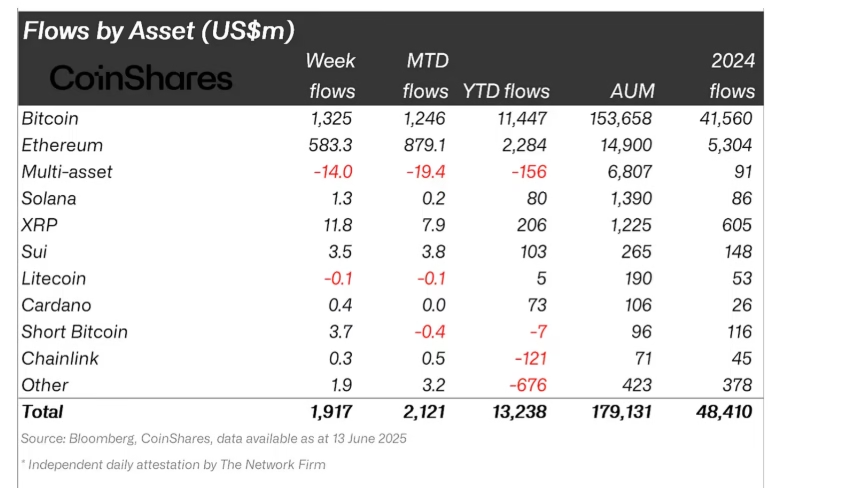

This surge in accumulation suggests growing confidence in Ethereum’s long-term potential. Institutional demand is also climbing, with Ether-focused investment funds seeing $583 million in inflows in just one week, raising the year-to-date total to $2.28 billion.

Ethereum Mirrors 2017’s Chart Pattern, Analysts Eye $4K to $10K

Analysts believe Ethereum’s current price behavior closely mirrors its 2017 consolidation phase, which preceded a 1,000% rally. Then, ETH hovered in the $10–$20 range before skyrocketing past $1,500. Today, the price is fluctuating between $2,150 and $3,600.

This channel is critical. ETH is maintaining its position above both the 50-week and 200-week exponential moving averages — technical signs of strength. Milkybull Crypto, a respected analyst, sees a breakout toward $4,000 in the short term, with a longer-term possibility of reaching $10,000 if historical trends repeat.

Pectra Upgrade and Institutional Backing Add to Bullish Outlook

Ethereum’s fundamentals are evolving. The upcoming Pectra upgrade and recent restructuring of Ethereum’s foundation team have boosted investor optimism. Alongside whale accumulation and fund inflows, these developments may help Ethereum escape its current range.

While past performance doesn’t guarantee future results, the alignment of whale behavior, institutional interest, and chart patterns paints a bullish picture.

ALSO READ:Pi Network .pi Domains Sell Out Fast, But Real Projects Still Missing

DISCLAIMER:

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of the publisher. The publisher does not endorse or guarantee the accuracy of any information presented in this article. Readers are encouraged to conduct further research and consult additional sources before making any decisions based on the content provided.